Strategic Initiatives

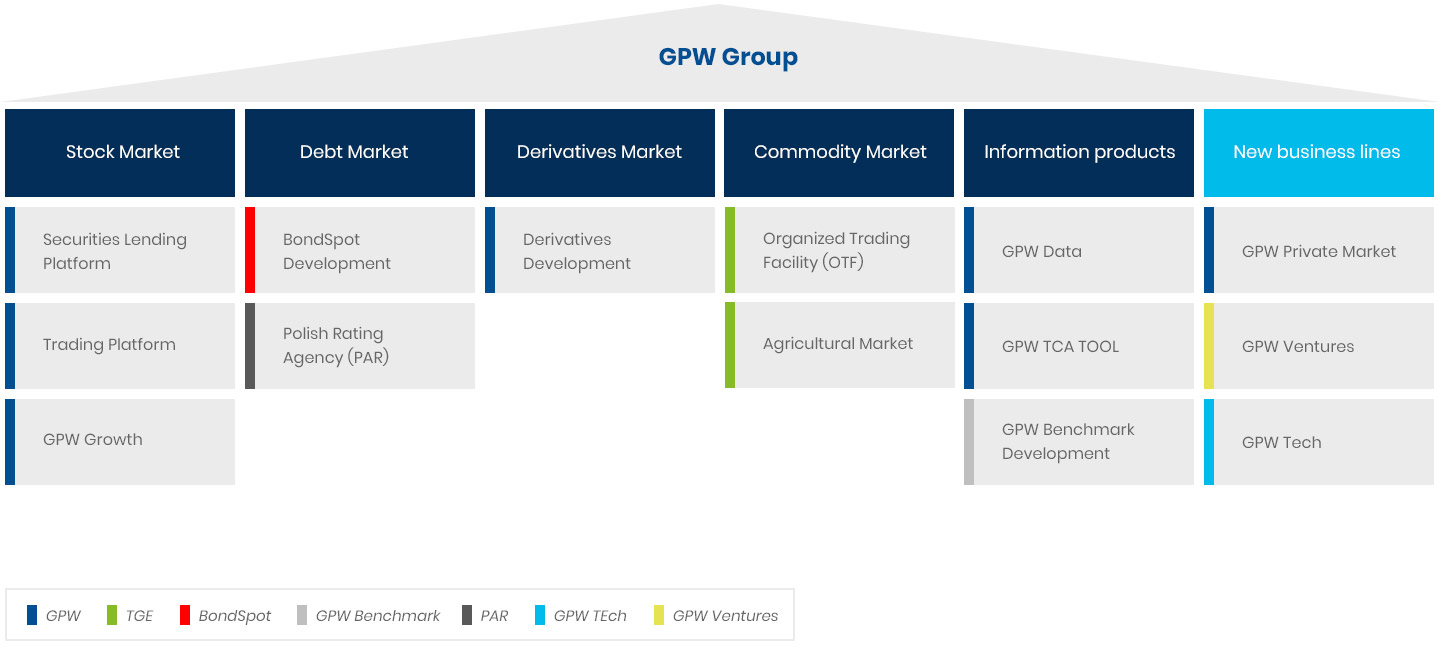

Under the Strategy #GPW2022, the GPW Management Board pursues with dedication the published strategic initiatives aiming to strengthen the business position of the GPW Group.

Current list of the #GPW2022 strategic initiatives:

- Primary Market Development (GPW Growth) – a comprehensive educational programme supporting SMEs. The project’s pillar is the implementation and development of GPW Growth, a programme supporting company value creation through expansion based on external sources of financing, in particular the capital market;

- Securities Lending & Borrowing – improved liquidity on the GPW Group’s cash and derivatives markets through promotion and expansion of securities lending and borrowing;

- Derivatives Development – new futures tailored to clients’ needs, promotion of market maker orders supporting liquidity of the order book, extension of promotional and educational programmes for all groups of investors;

- GPW Private Market – a platform matching companies and investors on the private market. Expansion of the GPW Group’s offer for companies at all stages of growth;

- GPW Ventures – an SPV to invest in venture capital funds (VC) as a passive investor. Financing instrument supporting growth of Polish venture capital and, in the longer term, IPOs in Poland;

- BondSpot Development – a full range of products and services on the debt market, money market and market in derivatives based on bonds and interest rates on a single trading venue;

- Polish Rating Agency – promotion of reliable company credit scorings and ratings on the local fixed-income market, generating tangible benefits for the Polish economy in the mid-term;

- GPW Data – business reporting standards ensuring automatic data processing and lower reporting costs for companies, use of big data technologies in collecting data relevant to capital market investments and generating reports, implementation of artificial intelligence (AI) tools supporting local and foreign investors;

- GPW TCA TOOL – Transaction Cost Analysis (TCA). The project developed a set of tools to identify and analyse transaction costs as a source of information for investors and brokers on data aggregated at micro market level;

- Organised Trading Facility (OTF) – transformation of TGE’s forward commodity market into an organised trading facility (OTF) under MiFID II. The Project will allow TGE to further develop forward instruments with physical delivery of electricity and gas and financial instruments;

- GPW Tech – the core business of the company is to build, develop and commercialise IT solutions dedicated to the financial market;

- Trading Platform – research and development work aiming to develop and implement a state-of-the-art integrated Trading Platform with breakthrough capacity and performance parameters and innovative communication protocols and trading algorithms;

- Agricultural Commodity Market – an electronic organised trading platform for agricultural and food products.

- Development of GPW Benchmark – the administrator of interest-rate benchmarks, regulated market indices and other benchmarks, including the Reference Rates WIBID and WIBOR, the Exchange Indices, TBSP.Index and CEEplus, and development of the offer of indices and benchmarks in those areas.

In addition, #GPW2022 includes a number of strategic initiatives which are not public at this stage. Such initiatives will be published depending on progress of work.

The updated growth strategy #GPW2022 provides for creation of shareholder value through the development of existing and new business lines and segments and continued profitability and risk management regime.

The strategy update focuses on four areas of growth of the GPW Group including:

- development of the core business,

- growth through diversification and expansion to new business areas,

- development of new technological solutions,

- continuation of the attractive dividend policy.