Risks and opportunities

The operation of the Warsaw Stock Exchange Group is exposed to various risks, both external related to the market conditions, the legal and regulatory environment, and internal related to the operating activities. In pursuit of its strategic goals, the GPW Group actively manages its risks aiming to mitigate or eliminate their potential adverse effect on the Group’s results.

The goal of GPW risk management is to ensure that all material risks of GPW’s activity are properly measured, reported and controlled and do not pose a threat to the operational stability and continuity of the Company. The risk management system includes a range of processes, organisational solutions, technology tools and documented rules for risk management. The key assumptions and principles of the Company’s risk management system derive from the Warsaw Stock Exchange Risk Management Strategy (“Strategy”) approved by the GPW Management Board and regularly reviewed to bring it in line with changes of the GPW risk profile and the market environment.

The key role in the risk management system is that of the Exchange Supervisory Board, which approves the Strategy at the request of the Management Board. The Exchange Supervisory Board is supported by the Audit Committee in supervising the GPW risk management system through on-going monitoring and assessment of the GPW risk management system. Risk management is a responsibility of the Exchange Management Board supported by the Risk Management Committee. The Company’s Management Board establishes and implements the Strategy and takes the key decisions affecting the risk levels. The GPW risk management process is monitored and controlled by the Compliance and Risk Department. Effective operations and assessment of the effectiveness of the risk management system as well as its adequacy for the GPW risk profile are regularly reviewed by the Internal Audit Department.

GPW builds an organisational culture which focuses on effective risk management, compliance with procedures, as well as enforcement of the rules of conduct. For this purpose, steps are taken in order to raise GPW employees’ awareness of risk management responsibilities at each level of the GPW organisation, including training, risk management information available to employees, and on-going advice.

GPW risk management process

The GPW risk management process is continuous and includes the following elements:

- Risk identification – identification of existing and potential sources of risk which impact or may impact GPW’s financial position.

- Risk assessment – analysis of internal and external threats to GPW’s operation in order to determine the risk profile.

- Risk prevention or acceptance – application of any of the following strategies:

- risk mitigation;

- risk transfer, e.g., transfer of risks of a threat in whole or in part to a third party;

- risk avoidance by taking no action involving the threat;

- risk acceptance.

- Risk review – periodic review of the effectiveness of the existing risk management system and its adequacy for the GPW risk profile.

- Risk monitoring – monitoring the gap between risks and projections or benchmarks. Risk monitoring is an early warning system and triggers management actions when adverse change to the GPW risk profile is identified.

- Risk reporting – regular reporting of risk measurements, taken or recommended actions to the GPW authorities.

Risk

GPW’s risk management strategy covers the following risks:

Non-financial risks:

- business risk, including: economic environment risk, strategic risk, competition risk, project risk,

- operational risk, including legal risk,

- compliance risk,

- reputation risk.

Financial risks:

- credit risk,

- liquidity risk,

- market risk.

Non-financial risks

Non-financial risks:

- business risk, including : economic environment risk, strategic risk, competition risk, project risk,

- operational risk, including legal risk,

- compliance risk,

- reputation risk.

Business risk (17 risks have been diagnosed)

The Group’s business depends on conditions on the global financial markets. Economic trends in the global economy, especially in Europe and the USA, as well as the geopolitical situation in neighbouring countries impact investors’ perception of risks and their activity on financial and commodity markets. As global investors evaluate geographic regions from the perspective of potential investment, their perception of Poland and GPW may decline in spite of a relatively stronger macroeconomic situation compared to other countries of the region. Less active trading by international investors on the markets operated by the GPW Group could make the markets less attractive to other participants and reduce the amount of charged trading fees, which are the main source of the Group’s revenue. Combined with a stable cost level, this could reduce the GPW Group’s potential profit.

The economic situation and market conditions in other countries, especially during the COVID-19 pandemic, could impact the perception of the Polish economy and its financial markets. Although the economic situation of other countries could be materially different from the economic situation in Poland, investors’ risk aversion caused by the economic situation of other countries could reduce the volume of trade in financial instruments on GPW. In particular, an economic slowdown or crisis in Europe or unexpected economic crises in other parts of the world, especially caused by difficulties of some countries with the repayment of debt, could affect the assessment of investment risk in European economies and consequently cause a shift to safe havens, which could have an adverse impact on investors’ activity and sentiment and consequently an adverse impact on the activity of the Group, its financial position and results.

The conditions in the Polish economy impact strongly investors’ activity and sentiment on the Polish market and consequently the level of turnover on the markets of the Group. Changes in the state of the Polish economy affect the business and investment activities of issuers whose securities are listed on the markets operated by the Group, including their financial results, which in turn may affect the prices of these securities, the volume of transactions, as well as activities related to issuing new securities. Changes of investors’ activity and sentiment on the Polish market have a direct impact on the GPW Group’s trading revenue. In periods of economic instability and under conditions of risk aversion, the Group’s revenue may decrease; even combined with a strict cost discipline, this could reduce the GPW Group’s profits. In particular, GPW’s listing revenue depends directly on the prices of listed instruments. Furthermore, perception of higher risks of investment in Polish assets could restrict access to capital which could be invested on the markets of the GPW Group and could adversely impact prices of assets traded on the markets organised and operated by the Group. Changing FX rates could have an adverse impact on investment decisions and their frequency, which could affect the volume, value and number of transactions on the markets of the GPW Group and consequently also the Group’s revenue.

The volume of trading, the number of new listings and demand for the GPW Group’s products and services are affected by economic, political and market developments, both domestic and global, that are beyond the Group’s control, including in particular:

- general trends in the global and domestic economy and on financial markets;

- changes in monetary, fiscal and tax policies;

- the level and volatility of interest rates;

- inflation pressures;

- changes in foreign exchange rates;

- adoption of the euro as the currency of Poland (causing potential changes to monetary and fiscal policy or causing changes in the allocation of investor portfolios);

- change of Poland’s credit rating;

- institutional or individual investors’ behaviour;

- volatility in the prices of securities and other financial instruments;

- availability of short-term and long-term funding;

- availability of alternative investment opportunities;

- legislative and regulatory changes; and

- unforeseen market closures or other disruptions in trading;

- natural disasters and catastrophes, epidemics, terrorist attacks, technical failures and other events.

These events could have a significant impact on the activity of GPW Group clients, mainly issuers and investors. Their low activity could affect the Company’s trading and listing revenue, revenue from introduction of financial instruments, and consequently information services, and it could affect the GPW Group’s profit.

According to the Articles of Association of the Warsaw Stock Exchange (“Articles of Association”), the voting rights of shareholders who hold more than 10% of votes at the General Meeting are capped. However, the limitation does not apply to the Company’s dominant shareholder, the State Treasury, which holds 14,688,470 preferred shares of GPW with voting rights (each share confers two votes according to the GPW Articles of Association). The State Treasury held 51.77% of the total vote as at the end of 2020. Furthermore, the limitation on the voting rights does not apply to shareholders who hold more than 10,493,000 series A preferred shares (i.e., more than 25% of all preferred shares of the Company). Consequently, the State Treasury controls the Company and any other shareholder may use the exemption if it acquires more than 10,493,000 preferred shares (i.e., more than 25% of all preferred shares of the Company) from the State Treasury.

A shareholder holding the majority of votes at the General Meeting may elect most of the members of the Exchange Supervisory Board and may appoint the President of the Management Board. With its corporate rights, the State Treasury or another dominant shareholder that acquires shares of the Company from the State Treasury may directly influence resolutions passed by the authorities of the Company. The State Treasury has, and a dominant shareholder that buys shares from the State Treasury may have, material influence over the activity of the Company, including the development of its strategy and directions of growth, the election of members of the Supervisory Board (subject to the regulations concerning the election of independent members) and the President of the Management Board. The Company is unable to anticipate how the State Treasury or another dominant shareholder will exercise its rights and how their actions may impact the activity of the Company, its revenue and financial results, and its ability to implement the strategy. The Company is unable to anticipate whether the policies and actions of the State Treasury or another dominant shareholder will be aligned with the interests of the Company. It should be noted that changes of shareholders of GPW could result in a change of the entity which has material influence over the Company or a situation where GPW has no dominant shareholder.

The Polish Financial Supervision Authority unanimously authorised GPW Benchmark S.A. on 16 December 2020 as an administrator of interest-rate benchmarks including critical benchmarks.

The benchmarks provided by GPW Benchmark S.A. include the Warsaw Interbank Offered Rate (WIBOR), entered into the critical benchmark register referred to in Article 20(1) BMR. The authorisation allows GPW Benchmark S.A. to provide other interest-rate benchmarks in accordance with the BMR requirements.

PFSA’s authorisation of GPW Benchmark S.A. implies that the financial supervision authority considers the WIBOR provision process to comply with the requirements of EU law.

The key risks to a benchmark administrator include falling turnover, which could undermine representativeness required under the BMR. BMR requires benchmark users to put in place a plan in the event of cessation of the benchmark. The best option is to have an alternative benchmark. This implies a second risk: the ability of GPW Benchmark S.A. to provide scenarios of measures to be taken in the event of cessation of the benchmarks (e.g., alternative benchmarks). Other risks include a shrinking number of data contributors and competition in interest-rate benchmark provision (alternative benchmarks from other sources).

The Company holds 33.33% of the equity of Krajowy Depozyt Papierów Wartościowych (KDPW). The KDPW Group (with KDPW as the parent entity and KDPW_CCP as its subsidiary) is responsible for the operation and supervision of the depository, clearing and settlement system for financial instrument trade in Poland, with the exception of trade in Treasury bills where clearing and settlement are operated by the National Bank of Poland. As a minority shareholder, GPW has limited strategic and operational influence over the activity of KDPW. KDPW’s business model may be adversely impacted by a range of factors reducing its profits, including price pressures or reduced trading. Lower profits of the KDPW Group including lower dividend paid out by KDPW could have an adverse impact on future profits of the Group, which could in turn have a material adverse impact on the financial position and results of the Group.

GPW, GPW Benchmark and KDPW are required to pay contributions towards the annual budget of the Polish Financial Supervision Authority in respect of capital market supervision. The amount of the fees is defined on the basis of the expected cost of supervision over the Polish capital market within the year and the estimated revenue of the Polish Financial Supervision Authority from market participants. GPW has no control of the amount of the fees and it is unable to anticipate the exact amount to be paid to the Polish Financial Supervision Authority in a given year; consequently, it cannot predict the impact of the fees on the cash flows of the Group. An increase of the fees may have an adverse impact on the activity of the Group, its financial position and results.

The Group is exposed to the risk of concentration of trade among a small number of investment firms operating on GPW. In 2020 (according to GPW data), six Exchange Member had a share of more than 5% of trade in stocks on the electronic order book on the Main Market and 17 Exchange Members had a share between 1% and 5%.

Furthermore, three Exchange Members had a share of more than 15% each in the volume of trade in futures, jointly representing 53% of the volume of trade in futures. The loss of one or more of such Exchange Members could have a material adverse impact on the activity of the Group, its financial position or results.

Furthermore, the revenue from trade in equities and other equity-related securities represented 35.8% of the Group’s total sales revenue in 2020. In that period, the top five companies with the biggest share in trade on GPW generated 43.3% of the average monthly value of trade in shares on the electronic order book on the Main Market while the top 10 companies generated 63.4%. The concentration of a large part of the Group’s revenue in the context of a small number of issuers and securities generates material risks. In particular, if those and other major issuers decide to have their shares delisted, it could have an adverse impact on the activity of the Group, its financial position, results and outlook.

Trade in derivatives is the Group’s second largest source of revenue from trading on the financial market and accounted for 6.0% of the Group’s sales revenue from trading on the financial market and 3.8% of the Group’s total revenue in 2020. The vast majority of the Group’s revenue from trade in derivatives was generated by trade in a single product: WIG20 futures. A large decrease in trade in WIG20 futures could have an adverse impact on the revenue from trade in derivatives, which could have a material adverse impact the activity of the Group, its financial position and results.

The exchange industry has experienced and will continue to experience fast technological progress, evolving requirements and preferences of clients, launches of products and services integrating new technologies, as well as the emergence of new industry standards and practices. To remain competitive, the Group must continue to strengthen and improve its ability to respond to changes combined with the productivity, availability and functionality of automatic trading and communication systems. This will require the Group to continue attracting and retaining highly qualified staff and to invest heavily in continuous upgrades of its systems. Otherwise, the Group’s systems may become less competitive, causing client attribution and reduction of the volume of trade, which could have an adverse impact on the activity of the Group, its financial position and results.

The strategy of the Group provides among other things for improved attractiveness of GPW for a growing group of market participants, in particular by investing in state-of-the-art technologies, diversification and expansion of GPW’s activity by adding new products and services. The achievement of these goals depends on a range of factors which are beyond the Group’s control, in particular market conditions and the overall economic and regulatory environment. Furthermore, the identification and implementation of development initiatives takes time and requires higher operating costs and capital expenditures which could impact financial results. GPW is looking for ways to strengthen its business and leverage opportunities of further development. As a result, the Group is in a position to launch new products and grow its presence on other markets. If development initiatives prove ineffective, this could have an adverse impact on the goals (financial and otherwise) defined in the GPW strategy and on the financial results of the Group.

The global exchange industry is strongly competitive. In the European Union, competition in the trade and post-trade sectors is amplified by legal amendments designed to harmonise legislation of the EU member states and integrate their financial markets. Hence, the Group is exposed to the risk of competition from other exchanges and alternative trading platforms whose presence on the Polish market could adversely impact the activity of GPW. In particular, the GPW Group may face competition of multilateral trading facilities (MTF) and other venues of exchange and OTC trade. The launch of active trade in Polish stocks by MTFs could impact the value of trade in stocks on GPW. Their activity on the Polish market could take away part of the trading volumes handled by the platforms operated by the Group and exert additional pressures on the level of transaction fees, adversely impacting the activity of the Group, its financial position and results.

The trading cost on large foreign exchanges and MTFs is lower than on GPW, mainly due to the relatively small size of the market in Poland. Consolidations in the global exchange sector and the development of MTFs may increase pressures to reduce fees charged for trade on the financial markets. As a result, GPW clients could exert pressures on GPW to reduce listing and trading fees, affecting GPW’s revenue.

In January 2019, Treasury BondSpot Poland was appointed by Treasury Securities Dealers and approved by the Ministry of Finance as the electronic market which is the reference secondary trade platform for Treasury debt. Treasury BondSpot Poland is exposed to the risk that it may lose the status of operator of an electronic market if the Minister of Finance terminates the agreement with BondSpot S.A. (with a termination notice) upon initiating the procedure under Article 23(1) of the Treasury Securities Dealers Rules of 15 December 2018 at the request of more than 50% of Treasury Securities Dealers.

As a result, the Company has to take continuous measures necessary to ensure that TBSP remains an attractive market, mainly by providing a complete range of solutions typical of a Treasury bond market and by providing services of highest quality on competitive terms. Otherwise, if a new entrant offers more attractive market terms in Poland, BondSpot S.A. could no longer be entitled to operate the reference market, which would significantly affect the activities and financial position of BondSpot S.A. Furthermore, there is no guarantee that the Treasury Securities Dealers competition rules will not change in the future, which could directly or indirectly impact the volume of trade and, consequently, the revenue of the TBSP platform.

Following an analysis of development scenarios for GPW and the GPW Group, in view of fast changing information technology, including an evolution of trading system technology, GPW took measures to replace its technology within no more than 4-5 years. In September 2019, GPW initiated a research and development project aiming to develop a proprietary, modular, scalable trading system dedicated to GPW and its subsidiaries and to foreign exchanges of Central and Eastern Europe (CEE) seeking IT solutions matching their needs and specificity. According to the development strategy for the Polish capital market, on which the Exchange is a key institution, a proprietary IT solution allows to optimise operating costs and risks of the platform. The Project may generate significant capital expenditures of the Company, partly to be refinanced with a grant from the National Centre for Research and Development (NCBR). The project aims to replace the legacy system UTP, which has been in operation for 8 years. If the Project fails, it will likely be necessary to reopen the option of replacing the system with a new trading system acquired from a foreign vendor. There can be no guarantee that the capital expenditures of the Company required to replace the trading system will have no material adverse impact on the activity of the Group, its financial position and results.

The risk of the provision of capital market indices and benchmarks includes:

- the risk to representativeness of certain indices and benchmarks arising from economic and market conditions resulting in their cessation;

- the risk that the Exchange Indices may not fulfil the BMR requirements for the method to cover ESG factors and the decarbonisation trajectory;

- falling interest of users in indices which do not cover ESG factors and the decarbonisation trajectory following the implementation of certain financial market regulations concerning sustainable financing, including e.g. SFRD;

- operational risk of system capacity.

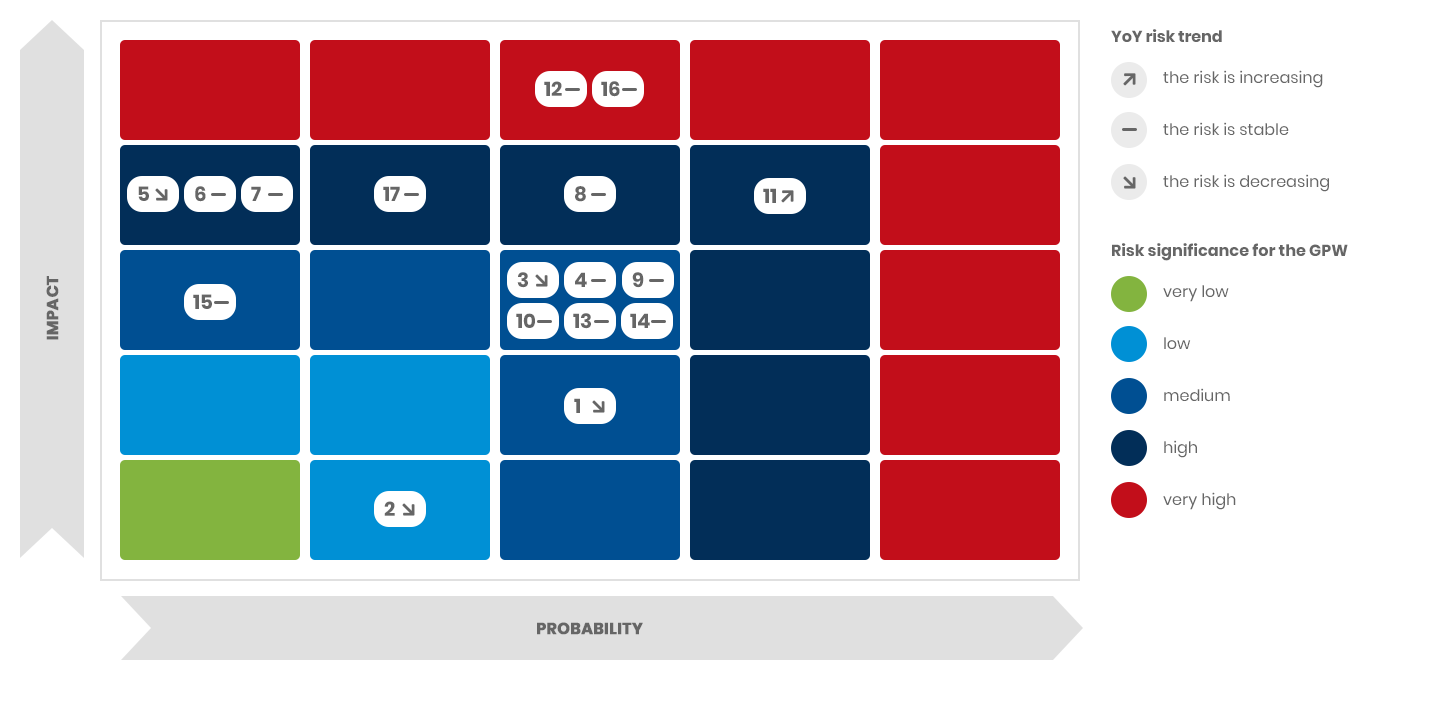

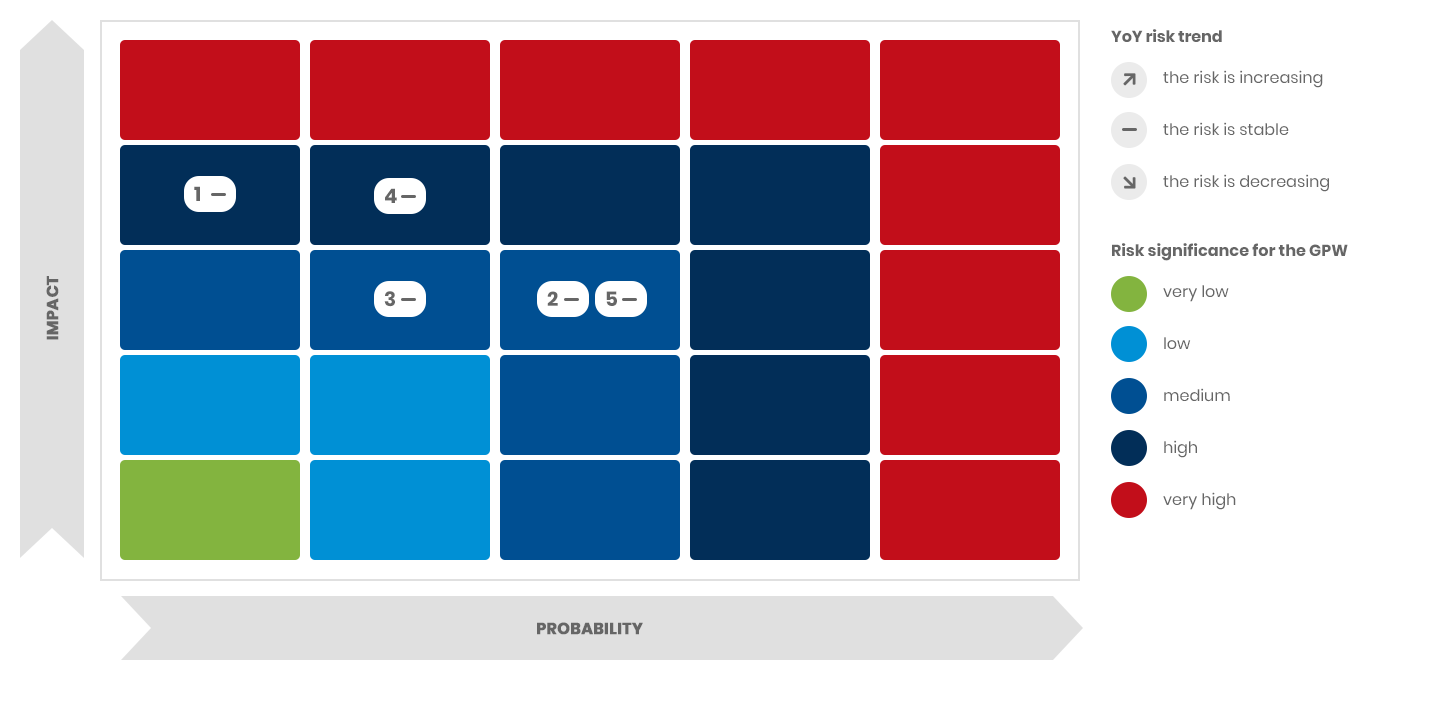

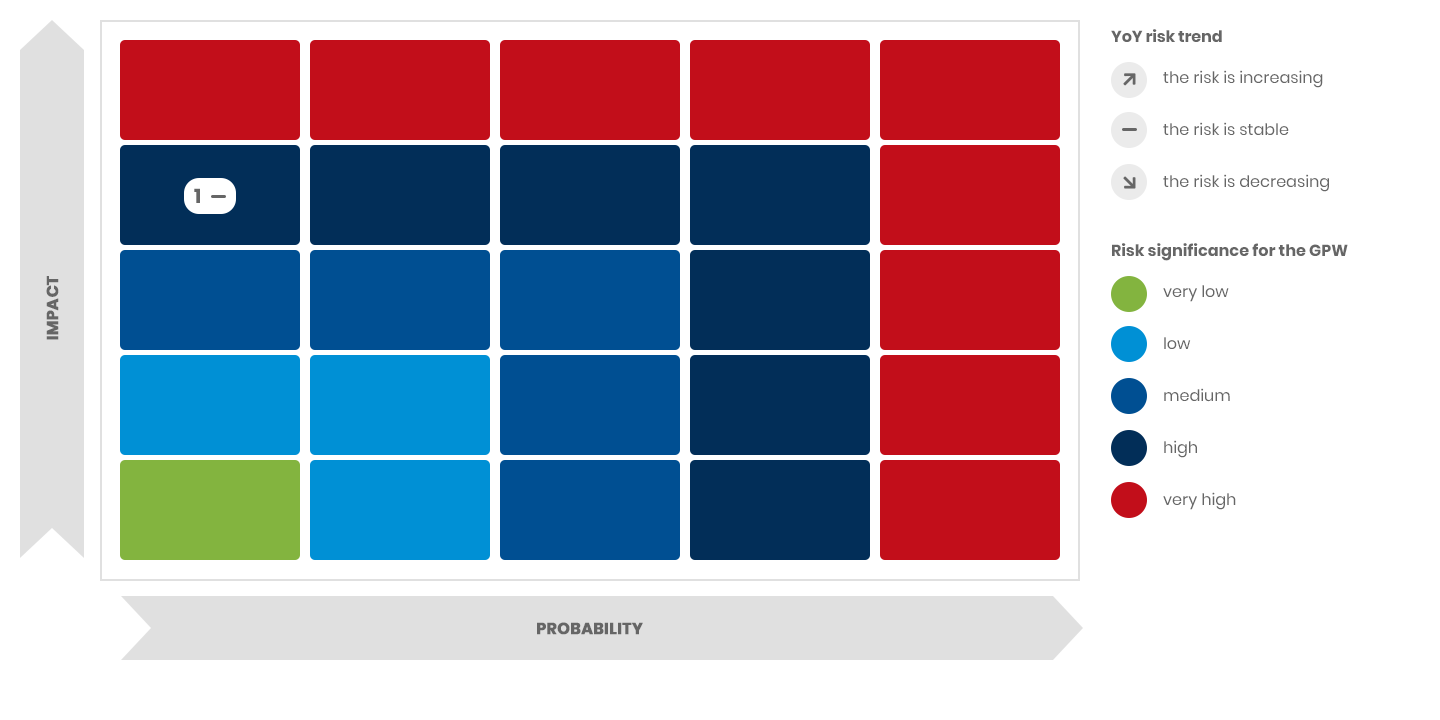

Risk matrix

List of risks in this area (17):

- Risks of the geopolitical and economic situation globally

- Risk of the economic situation of other countries

- Risk of the economic situation in Poland

- Risk of market and political events beyond the GPW Group’s control

- Risk of actions taken by the Company’s dominant shareholder where such actions are not in the interest or go against the interest of the Company or its other shareholders

- Risk of provision of Reference Rates WIBID and WIBOR

- Risk of reduced benefits of the Company’s investment in KDPW

- Risk of regulatory fees

- Risk of dependence of a large part of the Group’s sales revenue on trade in shares of a limited number of issuers and trade in futures by a limited number of Exchange Members

- Risk of concentration of trade due to dependence of a large part of the Group’s revenue from derivatives on trade in WIG20 futures

- Risk of technological changes

- Risk of failure to implement the Group’s strategy

- Risk of doing business in the sector of exchanges and alternative trading platforms

- Risk of price competition

- Risk of termination of TBSP’s reference market status

- Risks of necessary upgrades of GPW’s trading system

- Risk of the provision of capital market indices and benchmarks

Operational risk (6 risks have been diagnosed)

Effective management of the GPW Group’s business requires recruitment of highly qualified employees. The skills of the Group employees are scarce due to the unique nature of the GPW Group’s operations. Any increased turnover of key employees could temporarily affect the GPW Group’s effectiveness in view of the lengthy training process necessary to prepare new staff for such positions. This could have an adverse impact on the activity of the Group, its financial position, results, ability to achieve strategic targets, and outlook.

Most of the employees of the Company are members of the Trade Union of Exchange Employees, the sole trade union active in GPW since 2005. Trade unions are entitled to coordinate and consult opinion-making activities (including those related to restructuring of the Company). No industrial action has ever been filed by Group employees. However, there is no guarantee that the Group will not be involved in a future dispute which could have an adverse impact on its reputation, activity, revenue, results or financial position.

Safety and continuity of trading are among the key functions of GPW. The Group’s operations are strongly dependent on the effective functioning of its trading systems, which are subject to the risk of outages and security breaches. The reliability of the Group’s trading systems is as important as their efficiency. In the event that any of the GPW Group’s systems, or those of its third-party service providers, fail or operate slowly, it may cause any of the following to occur: unanticipated disruptions in services provided to the Group’s market members and clients; slower response times or delays in trade executions; incomplete or inaccurate recording or processing of trades; financial losses and liability to clients; litigation or other claims against the Group, including formal complaints with the Polish Financial Supervision Authority, proceedings or sanctions. Malfunctions in the trading systems and other integrated IT systems could disrupt a trading session and therefore cause a reduction in the volume of trading and affect confidence in the market, which could have a material adverse effect on the Group’s results, its financial position or development prospects. Furthermore, the Group may be forced to make additional material investments in security in order to improve security measures or mitigate existing issues, or to improve its reputation harmed by a potential security breach. Such factors could have an adverse impact on the Group’s activity, financial position or results.

The Group is exposed to market risk, regulatory risk, and financial risks including credit risk and liquidity risk of the Group’s investment portfolio, market risk generated by changes in prices of financial assets, as well as operational risk of its activity. The Group has a property insurance cover against risks including natural disasters, theft and burglary, vandalism, improper use of electronic equipment and inadequate power parameters. Furthermore, the Group has third-party liability insurance covering members of the Management Boards and Supervisory Boards (D&O). The Company has no third-party liability insurance for its operations, including potential damage incurred by Exchange Members and participants of trading due to IT system malfunctions. The Company believes that it has sufficient protection under the agreements signed with Exchange Members and participants of trading. These risk management measures and insurance policies may be insufficient to protect the Group against all risks to which it is exposed. The Group may not be in a position to effectively manage its risks, which could have an adverse impact on the activity of the Group, its revenue, results and financial position.

The GPW Group’s activity depends on third parties, including KDPW, KDPW_CCP, as well as several third-party service providers including mainly IT service providers. The ICT systems operated by the GPW Group for trading in financial instruments and commodities are highly specialised and customised, and are not widely used in Poland or elsewhere. Consequently, there is limited choice in service providers for such systems. There can be no assurance that any of the GPW Group’s providers will be able to continue to provide their services in an efficient manner, or that they will be able to adequately expand their services to meet the GPW Group’s needs. System interruption or malfunction or the cessation of important services by any third party in whole or in part and GPW Group’s inability to make alternative arrangements in a timely manner could strongly affect the Group’s operation, financial position and results.

In view of the insurance cover held by the Group, certain types of damage may not be covered by insurance or may be covered by partial insurance only. Furthermore, the Group could incur material losses or damage covered by no insurance or by limited insurance only. Consequently, the Group may have insufficient insurance cover against all damage that it could potentially incur. In the event of damage that is not covered by insurance or damage exceeding the sum insured, it may erode the Group’s capital. Furthermore, the Group may be required to redress damage caused by events not covered by insurance. The Group may also have liability for debt and other financial commitments related to such damage. Furthermore, the Group cannot guarantee that there will be no future material damage exceeding the Group’s insurance cover. Any damage not covered by insurance or damage exceeding the sum insured could have an adverse impact on the activity of the Group, its financial position and results.

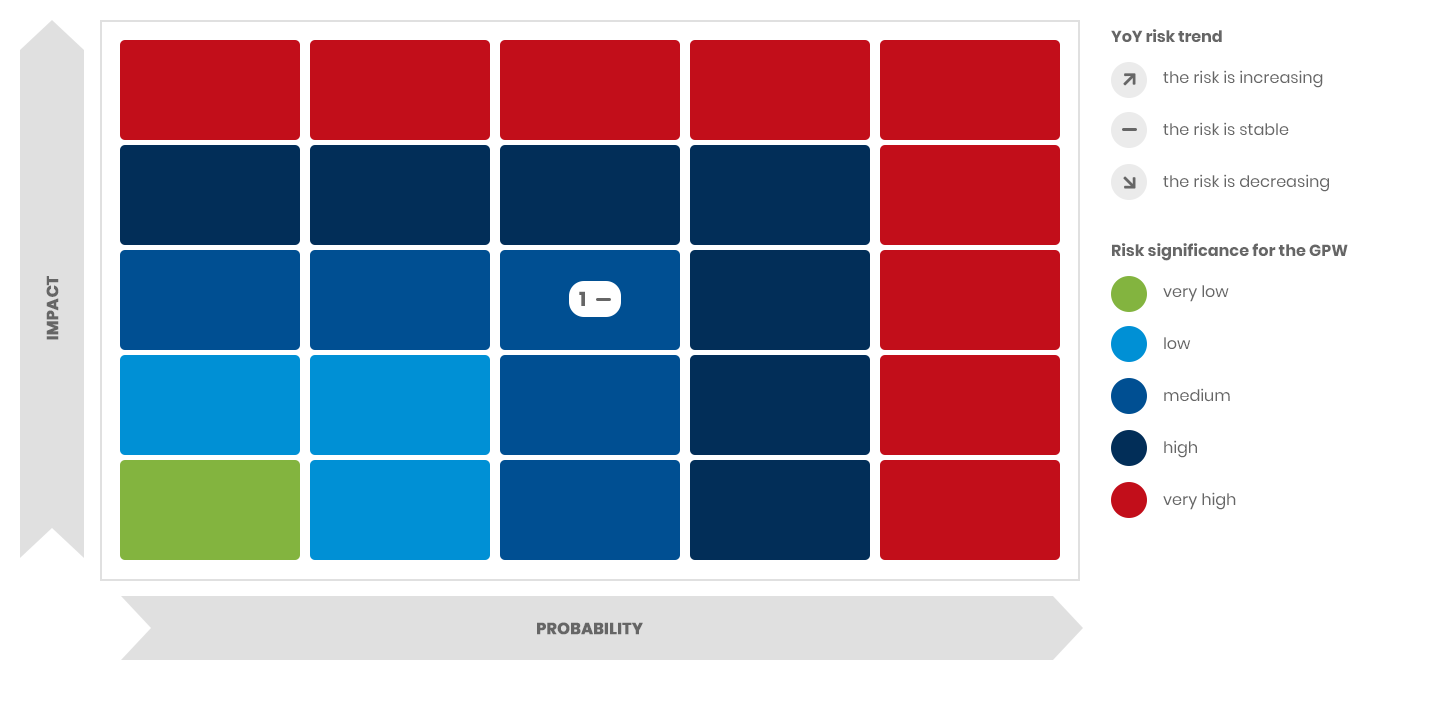

Risk matrix:

List of risks in this area (6):

- Risk of attracting and retaining qualified staff of the Group

- Risk of industrial disputes

- Risk of trading systems malfunction

- Risk of the Group’s risk management methods

- Risk of dependence of the Group’s activity on third parties over which the Group has limited or no control

- Risk of insufficient insurance cover

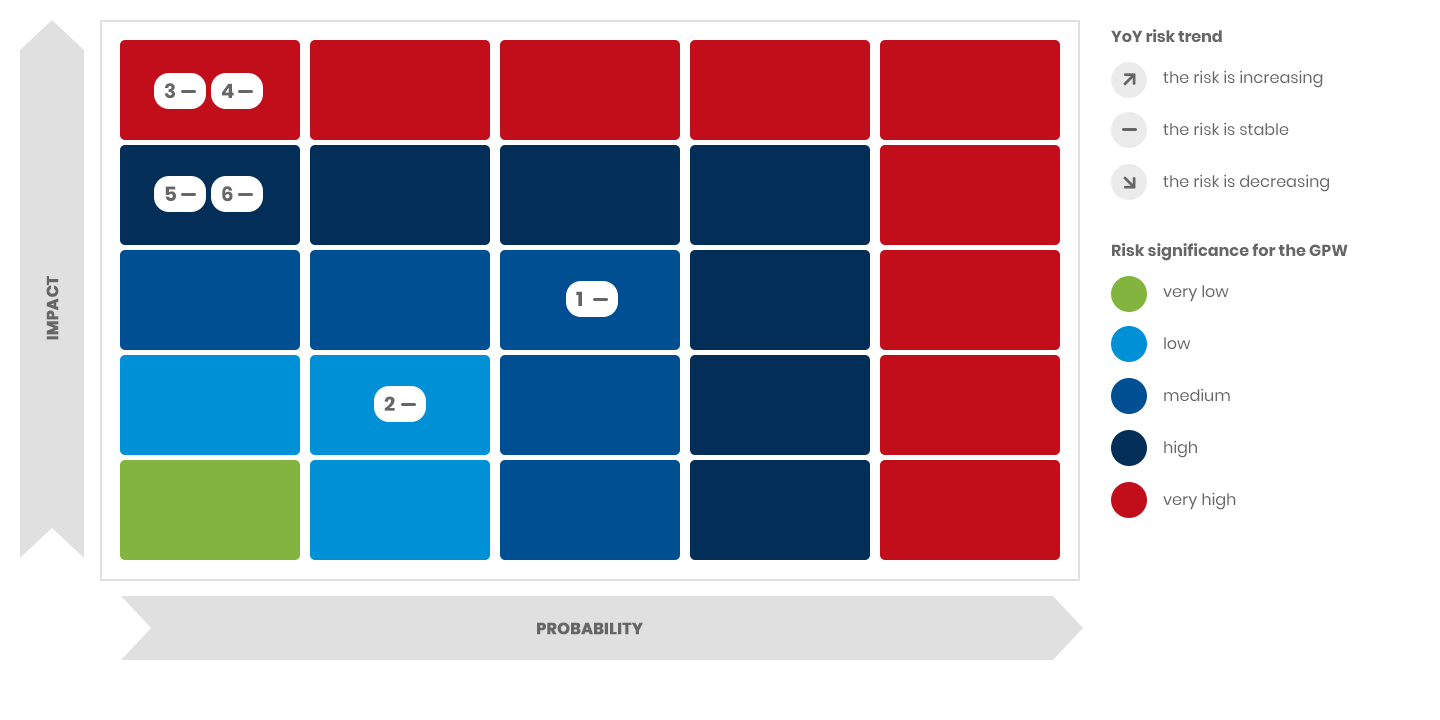

Operational risk - legal risk (7 risks have been defined)

The GPW Group operates primarily in Poland. The Polish legal system and regulatory environment can be subject to significant unanticipated changes and its laws and regulations may be subject to conflicting official interpretations. The capital market and the commodity market are widely subject to government regulation and may be subject to increasingly strict supervision. Regulatory change may affect the GPW Group as well as existing and prospective customers of its services. For instance, regulatory changes may affect the attractiveness of listing or trading on the markets organised and operated by the Group or the attractiveness of services provided by the Group. Such changes could also encourage companies listed on GPW to transfer to other markets which offer competitive listing costs or more flexible listing or corporate governance requirements.

The ability of the Group to comply with the applicable laws and regulations largely depends on its ability to develop and maintain the adequate systems and procedures. There is no guarantee that the Group will be in a position to comply with future amendments of laws and regulations or that such amendments will have no adverse impact on the activity of the Group, its financial position and results.

European Union regulation increasingly impacts the GPW Group and adds to the costs of compliance, especially in the area of trading and post-trade services. It could hurt the competitiveness of smaller European exchanges, such as GPW, in favour of larger market players. Changes to regulations could require the harmonisation of the Group’s trading systems and operations, which could entail additional capital and operating expenditures, resulting in reduction of the Group’s profit.

Open-ended pension funds are an important group of participants in the markets operated by the GPW Group. As at the end of Q4 2020, open-ended pension funds held shares listed on the local regulated market worth PLN 114.6 billion, representing approximately 21.3% of the capitalisation of domestic companies listed on the Main Market. Legislative amendments, which would replace open-ended pension funds with other collective investment undertakings and eliminate cash flows to/from pension funds, could impair the activity of this investor group on GPW. They could also augment the risk of an excessive supply of shares listed on GPW and curb the interest of other investors in such shares. As a consequence, this could cause a decrease of trade in financial instruments including shares on GPW, a reduction of the number and value of shares and bonds admitted and introduced to trading on GPW, and consequently a reduction of the GPW Group’s revenue and profit.

The Polish tax system is not stable. Tax regulations are frequently amended, often to the disadvantage of taxpayers. Interpretations of regulations are also changed frequently. Such changes could not only raise the tax rates but also add new specific legal instruments, extend the scope of taxation, or even impose new tax burdens. Changes of tax laws could also be driven by the implementation of new rules under EU legislation following the interpretation of new tax regulations or amendments of existing tax regulations. Frequent amendments of laws governing corporate taxation and different interpretations of applicable tax regulations by tax authorities could be to the disadvantage of the GPW Group, adversely impacting its activity and financial position.

The risk of inconsistency between local (Polish) tax regulations and the Union’s VAT Directive concerns doubts as to the tax policy and, consequently, the accounting policy of a taxpayer where input VAT from correctly issued invoices is deducted in accounts for the period when the tax obligation arises with respect to purchased goods if invoices for purchases in the financial period are received in the next financial period but before the deadline for the submission of VAT returns. That policy could generate the risk that tax authorities will follow the literal wording of Polish regulations, disregarding Union regulations, and challenge the date of input VAT deductions under Article 85(10b)(1) of the VAT Act (i.e., one of the conditions for input VAT deductions relating to the date of receipt of the VAT invoice would not be met).

The Group protects its intellectual property under agreements concerning trademarks, copyrights, protection of trade secrets, non-disclosure agreements and other agreements with its suppliers, subsidiaries, associates, clients, strategic partners and others. The measures implemented by the Group may be insufficient, for instance, to prevent appropriation of information. Furthermore, protection of intellectual property rights of the Group may require significant investments of funds and human resources, which could have an adverse impact on the Group’s activity, financial position and results.

The Group’s competitors and other legal and natural persons were likely to obtain and are likely to obtain in the future intellectual property rights in products or services related or similar to the types of products or services which the Group offers or intends to offer. The Group may be unaware of all protected intellectual property rights which may be at risk of infringement by the Group’s products, services or technologies. Furthermore, the Group cannot be certain that its products and services do not infringe on the intellectual property rights of third parties and that third parties will raise no claims against the Group due to such infringement. If the Group’s trading system or at least one of its other products, services or technologies is considered to infringe on the rights of third parties, the Group may be forced to discontinue the development or introduction into trading of such products, services or technologies, to obtain a necessary licence from the holders of intellectual property rights, or to modify such products, services or technologies to avoid infringement of such rights. If the Group is forced to discontinue the development or introduction into trading of some products or is unable to obtain a necessary licence, it may have a material adverse impact on its activity, financial position and results.

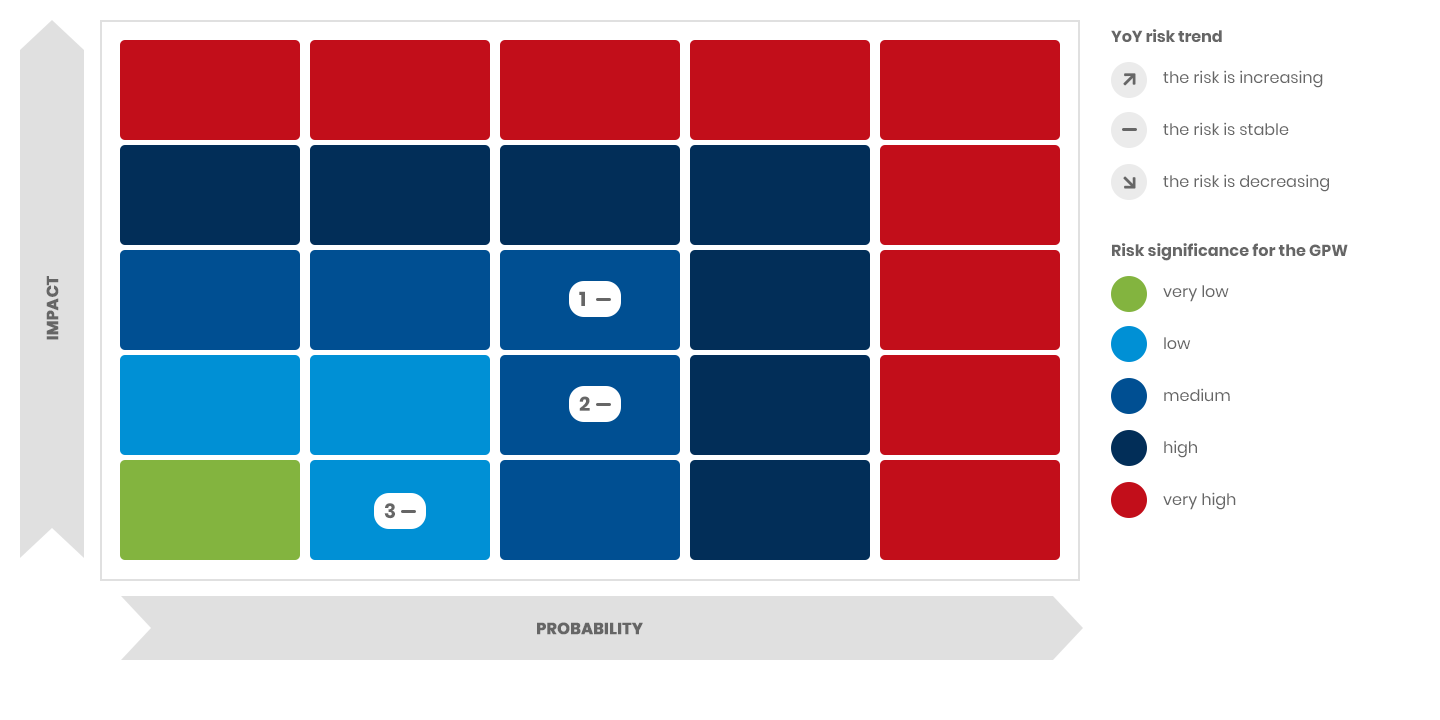

Risk matrix

List of risks in this area (7):

- Risk related to amendments of national laws and regulations

- Regulatory risk related to EU law

- Risk of regulations governing open-ended pension funds in Poland

- Risk of amendments to and interpretations of tax regulations

- Risk of inconsistency between Polish and Union tax regulations, for instance concerning VAT

- Risk of ineffective protection of intellectual property

- Risk of potential litigation due to the Group’s infringement on intellectual property rights of third parties

Compliance risk (5 risks have been defined)

The Group is supervised by the Polish Financial Supervision Authority. The Group may be unable to comply with all regulatory requirements and recommendations of the supervisory authority and thus it may be exposed to future proceedings and sanctions (including cash penalties) imposed due to the Group’s non-compliance or alleged non-compliance with its obligations under the applicable laws and regulations as well as recommendations of the supervisory authority. Any such proceedings against the Group and resulting sanctions could have a material adverse impact on the activity of the Group, its financial position and results. The Group has never before failed to comply with regulatory requirements and recommendations of the supervisory authority.

The ability of the Group to comply with all applicable laws in a changing regulatory environment is largely dependent on the implementation and maintenance of a compliance, audit and reporting system as well as on the ability to attract and retain qualified staff responsible for the processes. The Group can give no guarantee that its policies and procedures will be effective at all times or that it will be able at all times to adequately monitor and properly assess compliance risks to which it is or may be exposed. Non-compliance with laws and standards could reduce the activity of participants, issuers and investors, adversely impacting the activity of the Group, its financial position, results and outlook.

GPW has a dominant position on the Polish market. Consequently, the Company is subject to certain limitations including the prohibition of abusing the dominant position and using anti-competitive practices under Polish and EU competition laws. Competition authorities (President of the Office of Competition and Consumer Protection (UOKiK), Commission) may monitor compliance with such limitations. If the Company is found to be in breach of any such limitations, the competition authorities may require the Company to take specific measures in order to discontinue an anti-competitive practice or to discontinue abusing the dominant position, and impose sanctions including cash penalties on the Company up to 10% of revenue earned in the year preceding the year when the penalty is imposed. Such measures could have a material adverse impact on the Group’s activity, financial position and results.

The authorisation to operate as an administrator imposes the obligation to review and validate the methodology of benchmarks under BMR. As a result, GPW Benchmark will be exposed to operational risk and compliance risk due to oversight and control of the provision of benchmarks.

As a supervised entity, GPW Benchmark is exposed to the risk of non-compliance with the provisions of Regulation (EU) No 2016/1011 (BMR) which lay down the obligations of benchmark administrators, and to the risk of resulting supervisory sanctions. If such risks materialise, they could have an adverse effect to the reputation of the entire GPW Group.

The risk concerns the alignment of trading participants, issuers, and GPW including certain GPW Group members with the requirements of regulations which implement sustainable financing.

The Regulation of the European Parliament and of the Council on the world’s first-ever “green list” classification system of sustainable investments (taxonomy) was approved on 18 June 2020. The system will have to be used by:

- Member States and the European Union;

- Financial market participants who offer financial products: Financial market participants, as defined in the Disclosure Regulation, will be required to disclose information on how and to what extent the investments that underlie their financial product support economic activities that meet all the criteria for environmental sustainability under the Taxonomy Regulation;

- Financial and non-financial companies that fall under the scope of the Non-Financial Reporting Directive (NFRD). This refers to large public-interest companies with more than 500 employees, covering approximately 6,000 large companies and groups across the EU. More information: https://www.gov.pl/web/rozwoj-praca-technologia/zrownowazone-finansowanie.

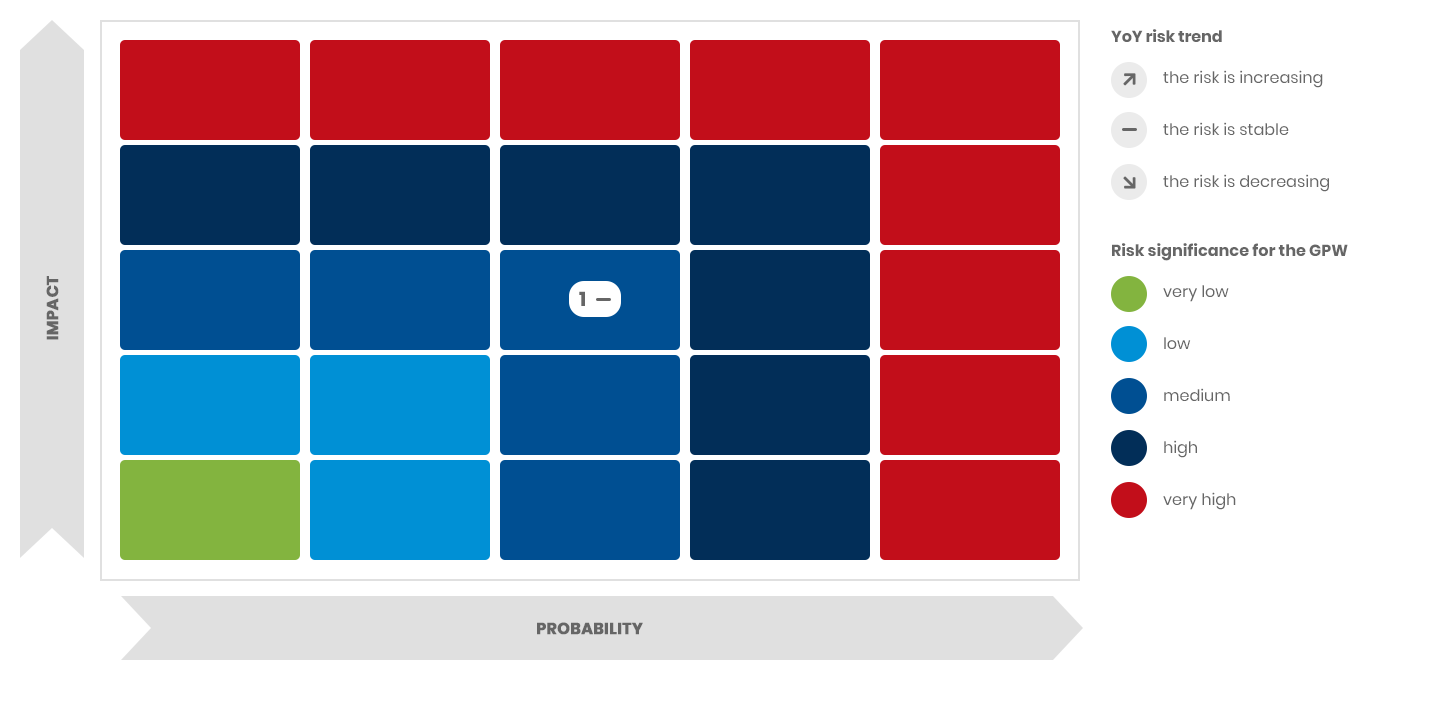

Risk matrix

List of risks in this area (5):

- Risk of non-compliance with regulatory requirements and recommendations of the Polish Financial Supervision Authority applicable to the activity of the Group

- Risk of internal regulations of the Company

- Risk of potential breach of competition laws by the Company

- Risks of Benchmark Administrator

- Risk of no or slow alignment with sustainable investment

Reputation risk (defined as 1 risk)

The Group operates in a sector where strong reputation and trust of clients (including issuers, financial intermediaries, and investors) are particularly important. The Company has achieved a relatively high volume of trade and a high number of IPOs among others owing to its reputation and clients’ trust. In view of the role of the Group on the Polish capital market, its reputation could be harmed by any malfunctions of the trading system, trading interruptions, operational errors, disclosure of client information, litigation, press speculations and other adverse events. Unexpected changes of regulations governing the capital market and the commodity market in Poland, as well as actions of other participants of the exchange market, including issuers, financial intermediaries, competitive trading platforms and the media, in breach of accepted standards of conduct or good practice, could undermine overall trust in the Polish capital market and the Group. Furthermore, there is a risk that employees of the Group could be in breach of the law or procedures while measures taken by the Group to identify and prevent such behaviour could in certain cases be ineffective, resulting in sanctions and causing a serious harm to the reputation of the Company. No events have ever had a material adverse impact on the reputation of the Group or trust of clients.

Risk matrix

List of risks in this area (1):

- Reputation risk

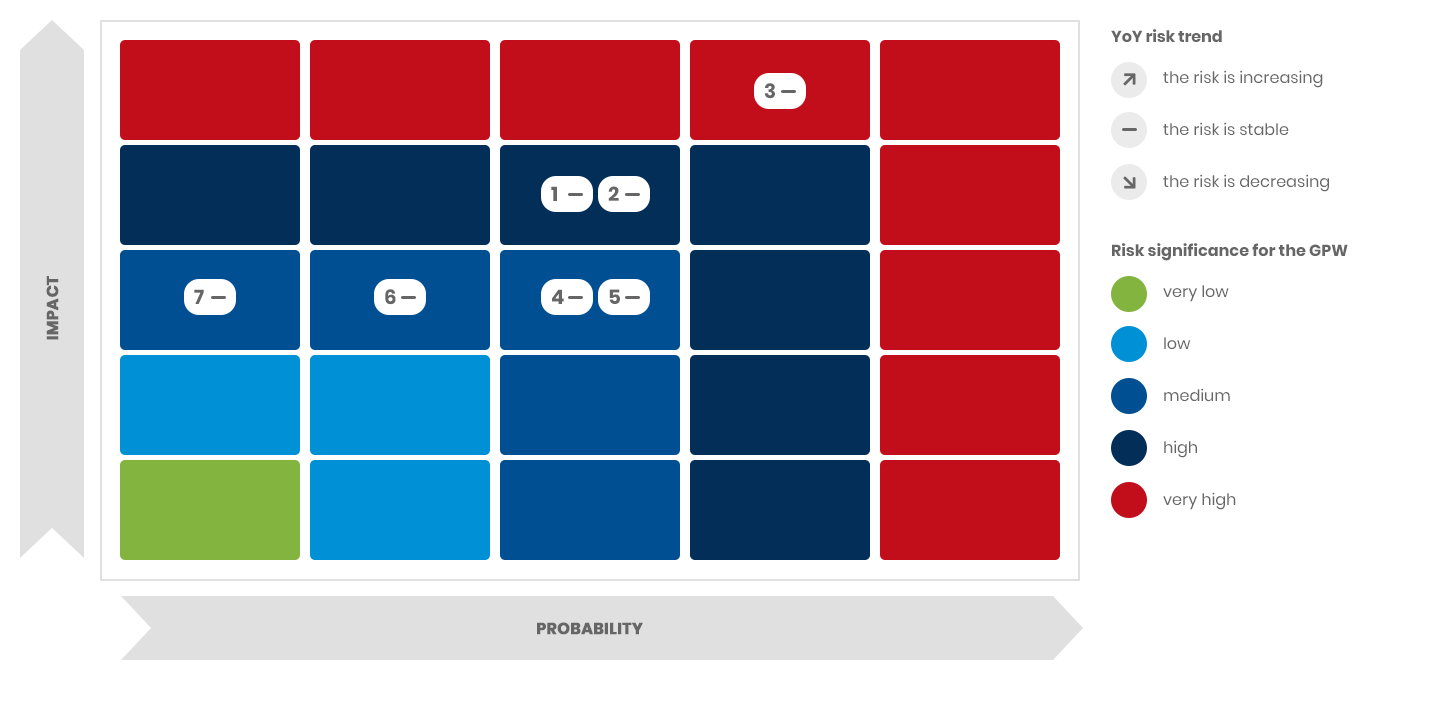

Financial risk factors

The Group is exposed to the following financial risks:

- market risk:

- credit risk,

- liquidity risk.

The Group’s overall risk management programme focuses on the unpredictability of financial markets and seeks to minimise any potential adverse effects on the Group’s financial performance. The Management Board of the Exchange and the Management Boards of the subsidiaries are responsible for financial risk management. The Group has dedicated departments responsible for ensuring its liquidity (including foreign currency liquidity), debt collection and timely payment of liabilities (particularly tax liabilities).

Market risk (3 risks defined)

The Group is moderately exposed to interest rate risk.

The Group invests free cash in bank deposits, corporate bonds, Treasury bonds, certificates of deposit, and other instruments where the interest rate is fixed, negotiated and determined when contracted at levels close to market rates at contracting. If market rates rise, the Group will earn higher interest income; if market rates fall, the Group will earn lower interest income.

The Exchange is an issuer of series C bonds at fixed interest rates as well as series D and E bonds at floating interest rates based on WIBOR 6M. In the case of an increase in interest rates, the Group will be obligated to pay out interest coupons on series D and E bonds with a higher value; in the case of a decrease in interest rates, the value of those coupons will be lower (which has a direct impact on financial expenses of the Group).

The Group is exposed to moderate foreign exchange risk. The Group earns income in PLN and EUR. The Group pays costs mainly in PLN and also in EUR, USD and GBP. To minimise FX risk, the Group uses natural hedging, i.e., it covers the current cost denominated in EUR with cash deposited in a currency account, raised from clients who pay their debt in EUR. The Group used no derivatives to manage FX risk in 2020 and in 2019.

Given the nature of its business, the Group is not exposed to any mass commodity price risk. The Group is minimally exposed to price risk of held equities measured at fair value. The value of such investments was not

significant as at 31 December 2020 and as at 31 December 2019.

Risk matrix

List of risks in this area (3):

- Cash flow and fair value interest risk

- Foreign exchange risk

- Price risk

Credit risk (1 risk diagnosed)

Credirt risk is defined as a risk of occurrence of losses due to the Group’s counterparty’s default of payments or as a risk of decrease in economic value of amounts due as a result of deterioration of a counterparty’s ability to pay due amounts.

Credit risk connected with trade receivables is mitigated by the Exchange Management Board and the Management Boards of the subsidiaries by performing assessment of counterparties’ credibility. In the opinion of the Exchange Management Board, there is no material concentration of credit risk of trade receivables within the Group.

In the parent entity, resolutions of the Exchange Management Board set payment dates that differ depending on groups of counterparties. The payment dates amount to 21 days for most counterparties, however, for data vendors, they are most often 45 days.

In the parent entity, the credibility of counterparties is verified in accordance with internal regulations and good practice of the capital market as applicable to issuers of securities and Exchange Members. In the verification, the Exchange reviews in detail the application documents including financial statements, copies of entries in the National Court Register, and notifications of the Polish Financial Supervision Authority.

The maximum exposure of the Group to credit risk is reflected in the carrying amount of trade receivables, bank deposits, corporate bonds, certificates of deposit, and other securities. By decision of the Exchange Management Board, the Group’s investment portfolio comprises only securities guaranteed by the State Treasury or issued (guaranteed) by institutions with a stable market position and high rating (rated above Baa2 by Moody’s). In this way, exposure to the risk of potential loss is mitigated. In addition, credit risk is managed by the Group by diversifying banks in which free cash is deposited.

Risk matrix

List of risks in this area (1):

- Credit risk

Liquidity risk (1 risk diagnosed)

An analysis of the Group’s financial position and assets shows that the Group is not materially exposed to liquidity risk.

An analysis of the structure of the Group’s assets shows a stable and rising share and value of liquid assets in total assets and, thus, a good liquidity position of the Group.

Risk matrix

List of risks in this area (1):

- Liquidity risk

Opportunities and prospects

Opportunities

An integrated report should answer the question: What are the opportunities whose materialisation could significantly affect governance of the company and its ability to create value over the short, medium, and long term.

Recovery of the IPO market

Global trends recovered on the Warsaw Stock Exchange in 2020: a difficult and uncertain Q2 was followed by a series of successful IPOs of technology, e-commerce, biotechnology, and gaming companies. GPW strengthened its position as a regional hub for gaming companies in 2020. The highlight of the year was the record-breaking IPO of Allegro worth PLN 10.6 billion (including the exercised option of additional allotment of 15% of shares). The positive trend on the IPO market initiated in 2020 is expected to continue into 2021.

New investors: growing interest in the stock market

Many new individual investors joined the stock market in 2020. KDPW operated more than 1.329 million securities accounts and omnibus securities accounts as at 31 December 2020. Close to 85 thousand new accounts (+6.8%) were opened during the year, the highest number since 2010 when interest in the stock market was fuelled by big privatisation projects (including GPW, Tauron, PZU).

Low interest rates

Record-low interest rates make the capital market a venue of choice for investors. According to NBP Governor Adam Glapiński, interest rate hikes in Poland are unlikely until mid-2022.

Technological development

Technological development dovetails with the mid-term and long-term growth strategy of the Warsaw Stock Exchange and the capital market. The subsidiary GPW Tech is responsible for the development of the GPW Group’s technological capacity and works on solutions dedicated to the capital market and in-house applications.

Agricultural Market

In March 2020, the GPW Group Consortium (TGE, IRGiT, GPW) in co-operation with the National Centre of Support for Agriculture (KOWR) opened the Agricultural Market: a trading platform for agricultural products which currently offers trade in wheat, rye, and maize. In the first year in operation, the market traded in wheat and rye (class B products). The turnover volume of wheat was 6,825 tonnes and the volume of rye was 25 tonnes. Warehouses located across Poland are getting authorised in the scheme: there are currently 41 authorised warehouses. Three brokerage houses are authorised to operate on the Agricultural Market, ensuring simple and swift trading. TGE is planning to open a forward market in food and agricultural products, starting with cereals. The product offer will be gradually extended.

ESG development

The Company focuses on initiatives which support the growing importance of sustainable development on the Polish capital market and continued development of in-house ESG competences. Initiatives in support of ESG development include the following:

- GPW in partnership with the European Bank for Reconstruction and Development published the “ESG Reporting Guidelines. Manual for GPW Listed Companies” which support issuers’ non-financial reporting in line with investors’ expectations.

- The “Best Practice for GPW Listed Companies 2021” came into force in July 2021. The new Best Practice incorporates ESG factors including climate, sustainable development, diversity in the corporate boardroom, and equal pay.

- The “Review of Integrated Reporting Market Practice”, a compilation of good practice in Poland based on the latest international IR Framework, was published in order to promote ESG and integrated reporting by GPW listed companies.

- We offered many training sessions to market participants.

- We joined the UN Global Compact in 2020.

- GPW continued to develop its product offer integrating ESG factors.

- The WIG-ESG index is the underlying of a passive fund managed by NN Investment Partners TFI.

Developments in the economic and regulatory environment

Positive macroeconomic developments and positive trends in the regulatory environment may boost the GPW Group’s revenue and improve value creation for GPW shareholders in the mid-term. Positive trends on the capital market may be supported by:

- continued promotion of Employee Capital Plans (PPK) – PPKs’ total assets under management reached PLN 2.8 billion as at 31 December 2020;

- reform of the pension fund sector – according to the Polish Financial Supervision Authority (KNF), pension funds had approx. 15.43 million members and their total assets under management stood at PLN 147.5 billion as at 31 December 2020.

Well-developed corporate organisational culture

The ability to swiftly adapt to the shock of the COVID-19 pandemic proved that the corporate culture of our organisation passed the test. The Management Board of the Exchange and the Management Boards of its subsidiaries took a range of measures necessary to mitigate the risk. In 2020, the Company handled record-breaking activity of participants of the financial and commodity markets while reengineering its operational model from a centralised to a dispersed one. The credit for our success in both fields goes to our excellent team and on-going digitisation, automation, and robotisation of our processes in the last years.

Implementation of the #GPW2022 Development Strategy

Since June 2018, the Company has pursued its strategic initiatives geared to further business diversification combined with the development of existing products. The Group focuses on initiatives geared to the following financial targets:

- GPW Group’s nominal revenue at PLN 470 million in 2022;

- EBITDA at PLN 250 million in 2022;

- ROE at 19 percent in four years’ time (2018-2022);

- C/I under 50 percent after 2022;

- dividend from the 2019 profit at least PLN 2.4 per share; annual increase in the dividend from the 2020-2022 profits by at least PLN 0.1 per share; however, the dividend will be no less than 60% of the annual consolidated net profit of the GPW Group attributable to the GPW shareholders, adjusted for the share of profit of associates.

The GPW Group has pursued its published strategic initiatives with dedication. The Company is expanding its revenue-generating lines in the expectation that it will benefit from the long-term opportunities provided by technological development and transition, the development of new products, support extended to companies (among others through education) at different stages of growth, and product development in line with global trends, including passive investments.

Capital Market Development Strategy (SRRK)

The Polish Government approved the Capital Market Development Strategy (SRRK) on 1 October 2019. The Strategy was published on 25 October 2019. The Capital Market Development Strategy aims to improve access to financing for domestic companies, in particular small and mid-sized enterprises which generate three-fourths of Poland’s GDP. The Capital Market Development Strategy identifies the top 20 barriers to the development of Poland’s capital market and indicates 90 actions that could help to overcome them. The key initiatives on the capital market include better liquidity, education, mitigation of gold plating, and support for sustainable development. The solutions offered in those areas by GPW include the analytical support programme, the bonds development programme, the GPW Growth Academy, and the review and publication of the Best Practice for GPW Listed Companies 2021. The GPW Group is working to identify additional initiatives. The GPW Group has so far identified 33 actions relevant to the Exchange and 6 actions relevant to GPW Group members.

Outlook of the Group’s financial position

The Group expects to generate significant cash flows from operating activities in the coming years which, combined with income generated by financial assets, will cover operating expenses, capital expenditure, and debt service costs of the Group. The debt of the Group posed no threat to its activity or timely payment of amounts due in 2020. Net debt to EBITDA remained negative, just like in 2019, as a result of negative net debt.

Looking at the Group’s cash position, one should consider jointly its cash and cash equivalents as well as financial assets measured at amortised cost which include bank deposits over 3 months, certificates of deposit and corporate bonds. Cash stood at PLN 421.2 million and financial assets measured at amortised cost stood at PLN 295.0 million as at 31 December 2020.

As at 31 December 2020, the Group held PLN 716 million in cash and cash equivalents and assets measured at amortised cost including bank deposits and guaranteed corporate bonds; in the opinion of the Exchange Management Board, those financial resources are sufficient to conclude that the Group’s short-term and mid-term liquidity risk is low.

The financial position of the GPW Group allows for continued organic growth and dividend payments in accordance with the dividend policy.

Short-term risk outlook

Considering the Group’s heavy dependence on its environment, regulatory risk arising from legislation has a significant impact on the activity of GPW.

Macroeconomic conditions in Poland and globally have a significant impact on the activity of GPW. According to economists, 2021 will definitely be better than 2020; how much better depends on the spread of the pandemic and the vaccination roll-out. Mass-scale vaccinations should build herd immunity, most likely helping to avoid another strict lockdown. However, the vaccination roll-out will take time, which suggests that some restrictions will continue into 2021, impacting the pace of the recovery.

Strategic risk remains neutral given that the time horizon of activities and the related budget ends in 2022.

The risk of technology changes is considered to be low in the short term.

Financial risks remain neutral in the short term and their impact on the activity of the GPW Group is small.