Operational Results

Financial market

The activity of the GPW Group is diversified and focuses on two markets: the financial market and the commodity market, where Group companies organise trade in financial instruments and commodities, and offer complementary services.

The activities of the GPW Group on the financial market include:

- trade in financial instruments on the regulated market and in the alternative trading system:

- trade in shares and other equity instruments on the Main Market and on the NewConnect market,

- trade in derivatives on the Main Market,

- trade in debt instruments on the Catalyst market organised by GPW and BondSpot and on Treasury BondSpot Poland (TBSP),

- listing, including introduction to trading and listing of financial instruments,

- information services including data from the financial market.

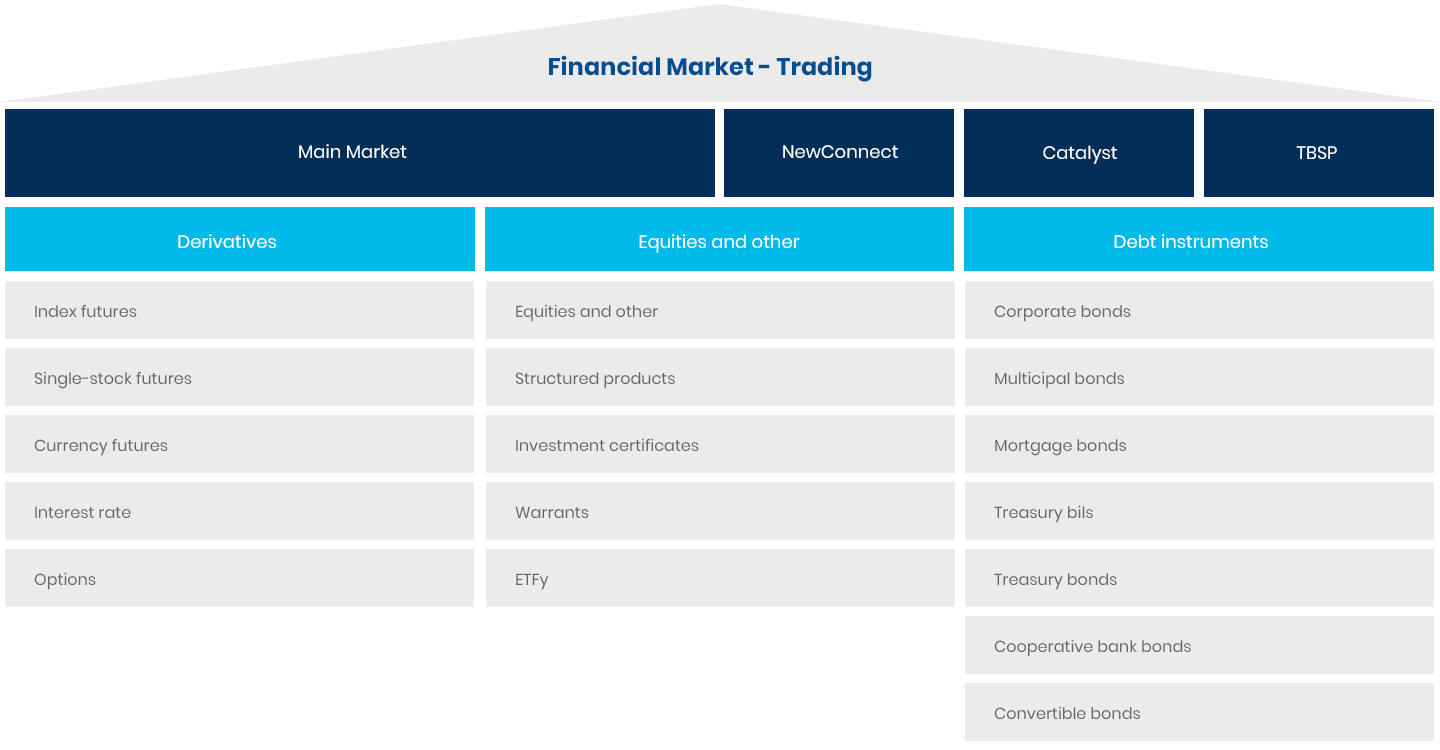

Trading

Trading encompasses trade in financial instruments on the Main Market and on GPW regulated markets NewConnect and Catalyst, and on Treasury BondSpot Poland.

Financial instruments in trading on the GPW Group financial markets

Stock market

The value of trade in shares on the electronic order book (EOB) on the GPW Main Market was PLN 297.3 billion in 2020, representing an increase of 55.3% year on year (PLN 191.5 billion in 2019). The average daily value of trade on the was PLN 1,234.6 million in 2020 vs. PLN 787.4 million in 2019. The number of EOB transactions was 33.5 million in 2020 vs. 17.9 million in 2019. The average value of EOB transactions was PLN 8.9 thousand vs. PLN 10.7 thousand. There were 252 trading sessions in 2020 vs. 248 sessions in 2019.

Value of trade in shares on the Main Market [PLN billion]

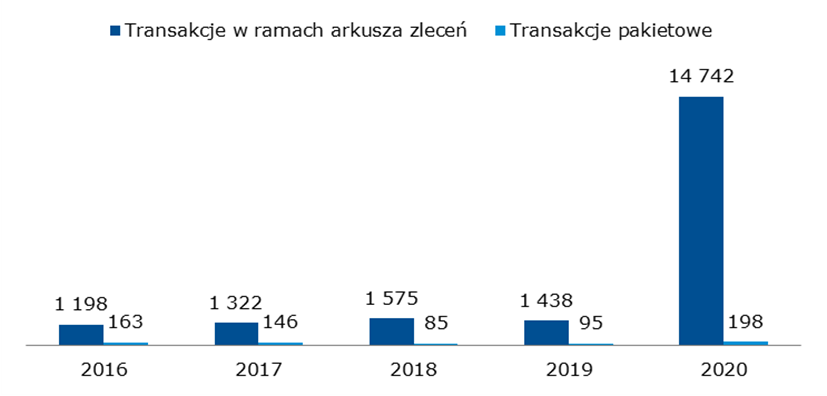

The value of trade on the electronic order book on NewConnect increased by 925.3 % year on year to PLN 14.7 billion in 2020 and the value of block trades increased by 110.1% year on year to PLN 198 million in 2020.

- In 2020, GPW hosted a new edition of the investor conference “GPW Innovation Day” as well as the event “Gaming on the Exchange”, where listed companies, including NewConnect companies, met with individual and institutional investors. In 2020, GPW hosted the webinar “Capital for Growth - #NewConnect” dedicated to NewConnect from the perspective of issuers as well as investors.

- In 2020, GPW in partnership with the NewConnect Authorised Advisors Council released the first comprehensive publication dedicated to NewConnect: “NewConnect. A Manual.” The manual provides a detailed description of the process of issuing and introducing shares to NewConnect, the role of Authorised Advisors on NewConnect, legal aspects including recent amendments of the Alternative Trading System Rules, national and EU law, as well as key issues relevant to obtaining and holding the status of a NewConnect listed company.

- GPW understands the huge potential of further growth of NewConnect in view of strong interest of companies in being listed on NewConnect combined with growing investor activity. NewConnect was named an SME Growth Market in 2019, which allows for regulatory facilitations for issuers. NewConnect is a very attractive option for small companies which look for growth capital and liquidity of shares. A dedicated section of GPW regularly meets with companies and participates in thematic and industry events to promote NewConnect.

Value of trade in shares on NewConnect [PLN million]

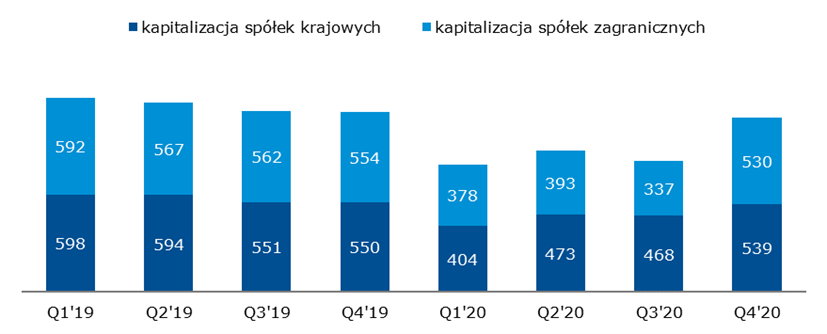

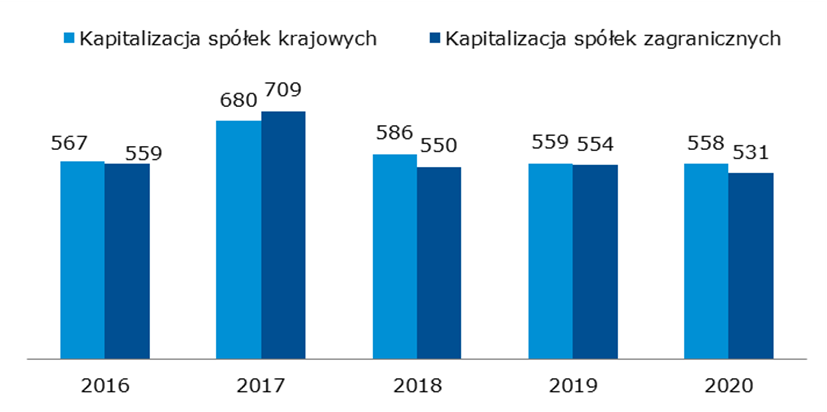

- The capitalisation of domestic companies listed on the Main Market was PLN 539 billion at the end of 2020. The capitalisation of foreign companies was PLN 530 billion at the end of 2020.

Capitalisation of domestic and foreign companies in 2019-2020 [PLN million]

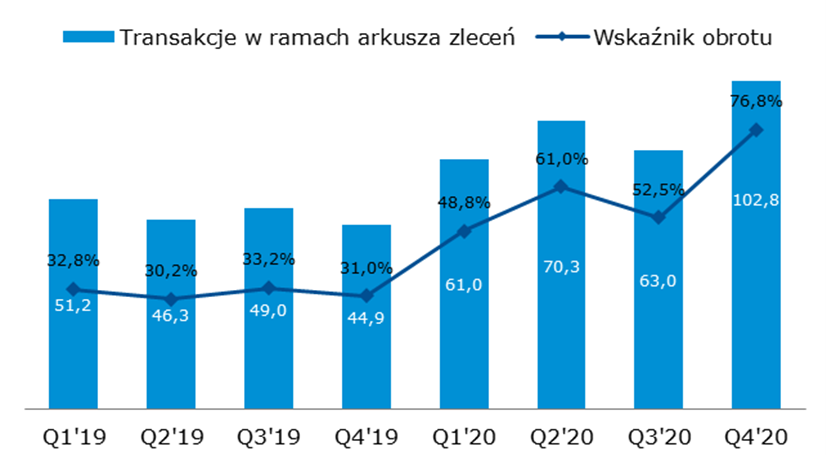

The velocity ratio measures turnover in relation to average monthly capitalisation. FESE statistics present velocity by month. On average, domestic equity trading velocity was the highest in Q4 2020 (76.8%). The average annual velocity ratio was 59.8% in 2020.

Turnover in shares on the Main Market [PLN billion] and velocity [%]

Source: GPW – trade on the electronic order book; FESE – domestic equity trading velocity.

GPW takes far-reaching initiatives to improve liquidity on the Main Market, mainly including acquisition of new clients, improvement of infrastructure and availability, and generation of additional volumes among others through active promotional programmes offering reduced transaction fees.

The colocation service was opened to GPW’s clients in Q1 2016. The service is dedicated to algorithmic traders seeking the closest possible access to GPW markets for themselves and for their clients. A new client joined the service in 2020. The colocation service is a key part of the capital market infrastructure which supports the segment of electronic liquidity providers and improves liquidity of the order book.

GPW attracted four new Exchange Members in 2020: HRTEU Ltd (Ireland); IBKR Europe S.a.r.L (Luxembourg).; Liquidnet EU Limited (Ireland); and Michael Strom S.A. (Poland).

The Super Market Maker programme was in effect in 2020. The programme supported liquidity of the cash market and the volume of trade in shares of the biggest companies participating in the WIG20 portfolio. The programme imposed much higher requirements for market makers’ orders on GPW (size, spread) but it also provided eligible participants with reimbursement of part of transaction fees. Similar schemes which encourage market makers to offer better quotes are available for all classes of derivatives.

- High Volume Provider (HVP) programme is addressed to entities which invest on own account only. Launched by GPW in November 2013, it offers promotional fees to those investors who generate at least PLN 5 million of trade in equities per session on the stock market or 150 thousand futures and options on the derivatives market. HVP mini, an additional threshold of minimum trade volumes under the High Volume Provider programme, was introduced in June 2017. The HVP mini thresholds are PLN 2.5 million on the cash market and 75 futures contracts or options on the derivative market. Trade under the HVP programme is aggregated on a monthly basis. An optional price list introduced in 2018 rewards HVP participants for passive orders in index futures. With the development of passive strategies used by programme participants, discounts on passive orders were extended in 2020 to cover single-stock futures.

- High Volume Funds (HVF) Programme: the programme is addressed to investment funds which actively trade in shares or derivatives on GPW. It was launched in July 2015. Similar to HVP, it is a fee promotion for those funds which generate daily trade in shares exceeding PLN 5 million or 150 futures and options. The conditions of eligibility for the programme included a high portfolio turnover ratio (200% per month), targeting mainly small and mid-sized funds which generate high monthly turnover. In 2020, that condition was replaced by the requirement for participants to be classified as an alternative fund within the meaning of the Alternative Investment Fund Managers Directive 2011/61/EU. The modification was designed to attract new participants of the programme. One new client joined the programme in 2020.

- Promotion for exchange members who are proprietary traders and enter into cross trades with clients – the dealer fee was reduced by 100% and the client fee for cross trades was reduced by 20%. The promotion was introduced in two steps: trading fees were reduced for dealers in H1 and for clients as of H2. The promotion is available for instruments listed on the Main Market and in the NewConnect ATS.

- Analytical Coverage Support Programme set up under the resolution of the Exchange Management Board of 25 March 2019 aims to improve liquidity among small and mid-caps. In exchange for a fee, brokers prepare and publish research on companies which enrol in the programme and meet the applicable criteria. In view of strong interest, the programme was extended to cover 12 more companies in 2020. Now the programme covers 51 companies.

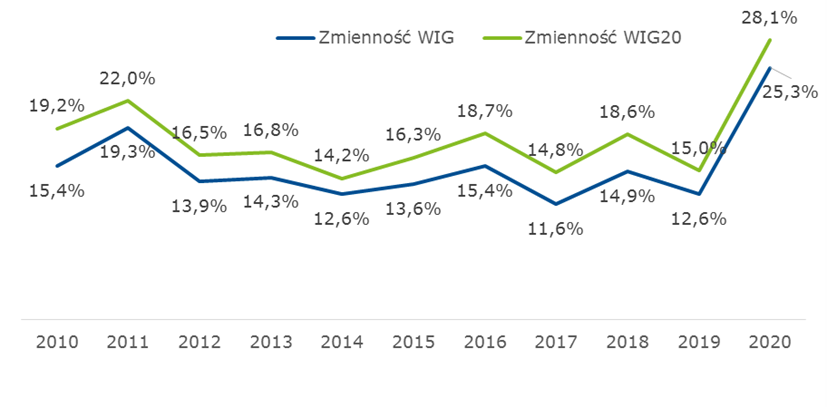

- All these initiatives were designed to improve liquidity. However, volatility remains a key parameter impacting investors. Volatility increased sharply in 2020 due to the Covid-19 pandemic.

Annual volatility of WIG and WIG20

Other cash market instruments

The GPW cash market also lists structured products, investment certificates and ETFs.

Numbers of products listed in 2020-2016

| As at 31 December [#] | 2020 | 2019 | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|

| Structured products (certificates) | 1 798 | 1 220 | 1151 | 942 | 784 |

| Structured products (bonds) | 9 | 1 | 0 | 1 | 0 |

| Investment certificates | 36 | 36 | 33 | 36 | 37 |

| ETFs | 7 | 6 | 3 | 3 | 3 |

In total, GPW listed 1,798 structured products that were investment certificates, 9 structured products based on bonds, 36 investment certificates, and 7 ETFs at the end of 2020, and the total value of trade in those instruments was PLN 3.68 billion in 2020 vs. PLN 1.54 billion in 2019 (+148% YoY). Trade in ETFs increased by 338% YoY (PLN 174 million in 2019 vs. PLN 768 million in 2020).

More than 2,100 structured products were introduced in 2020.

The percentage share in turnover is as follows:

- structured products (79%),

- ETFs (21%).

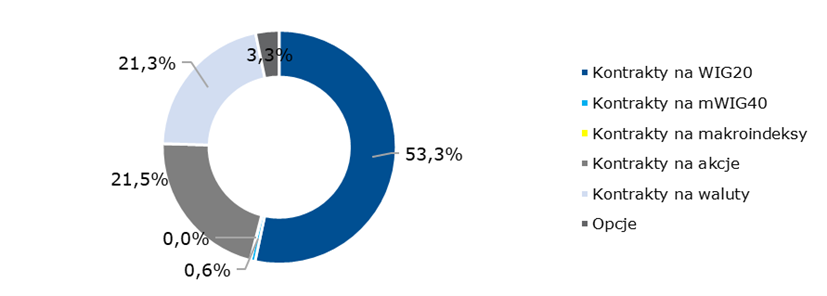

Structure of volume of trade in derivatives in 2020 by category of instrument

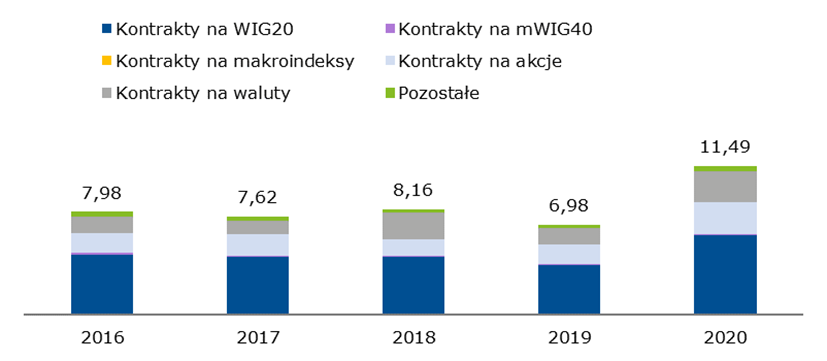

The total volume of trade in derivatives was 11.49 million instruments in 2020 vs. 6.98 million instruments in 2019. The increase was mainly driven by a rising volume of trade in WIG20 futures, from 3.88 million in 2019 to 6.13 million in 2020, and a rising volume of trade in currency futures, from 1.33 million to 2.44 million contracts. The number of open interest was 290.0 thousand as at 31 December 2020, an increase of 69.4% year on year (171.2 thousand as at 31 December 2019).

Volume of trade in futures, EOB and block trades [million instruments]

Volume of trade in options, EOB and block trades [thousand instruments]

The activity of investors on the derivatives market is largely driven by the volume of trade on the underlying instrument market but it is even more sensitive to volatility than investor activity on the cash market.

The volatility of WIG20 on the cash market was higher in 2020 than in previous years and reached 28.1% in 2020 vs. 15.0% in 2019. DLR (derivatives liquidity ratio equal to the nominal value of trade in index derivatives to the value of trade in the underlying) of WIG20 futures was 90 in 2020 vs. 102 in 2019. Similar to the cash market, GPW supports the liquidity of trade in derivatives by offering incentives to providers of liquidity for index futures, single-stock futures, bond futures, and options.

Liquidity on GPW’s financial derivatives market was additionally supported by the HVP and HVF programmes which continued in 2020. The share of programme participants in the total volume of trade in derivatives on GPW was 13.4% in 2020 vs. 10.0% in 2019. The share of programme participants in the volume of trade in WIG20 futures, which are the most liquid derivative contract, stood at 16.0% in 2020 vs. 13.4% in 2019.

Debt market

The GPW Group offers trade in debt instruments on Catalyst, which is comprised of regulated and alternative trading systems operated on the trading platforms of GPW and BondSpot. The following instruments are traded on Catalyst:

- corporate bonds;

- municipal bonds;

- co-operative bank bonds;

- convertible bonds;

- covered bonds;

- Treasury bonds.

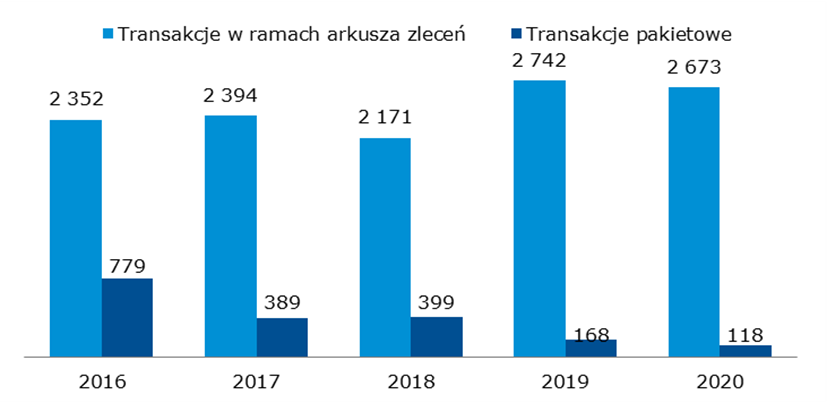

The value of trade in non-Treasury instruments on the electronic order book on the markets operated within Catalyst was PLN 2,673 million in 2020 vs. PLN 2,742 million in 2019 (decrease of 2.5% year on year) and the value of block trades was PLN 118 million in 2020 vs. PLN 169 million in 2019. The total value of trade in non-Treasury and Treasury instruments on Catalyst was PLN 2,792 million in 2020 vs. PLN 2,912 million in 2019, representing a decrease of 4.1% year on year.

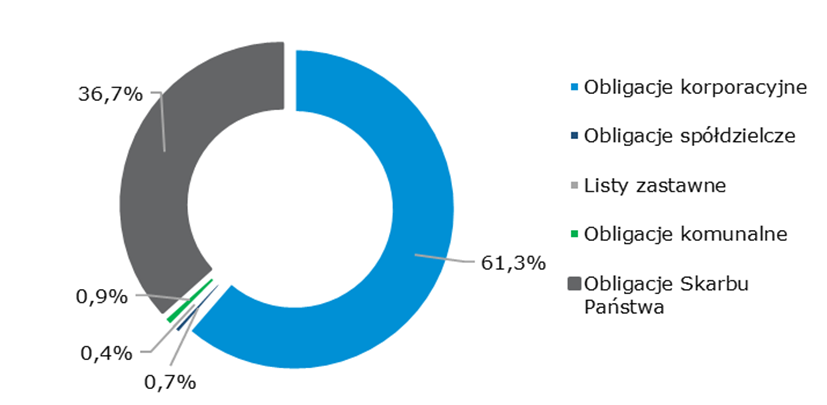

Structure of trade on Catalyst (EOB and block trades) in 2020 by instrument

Value of trade on Catalyst, EOB and block trades [PLN million]

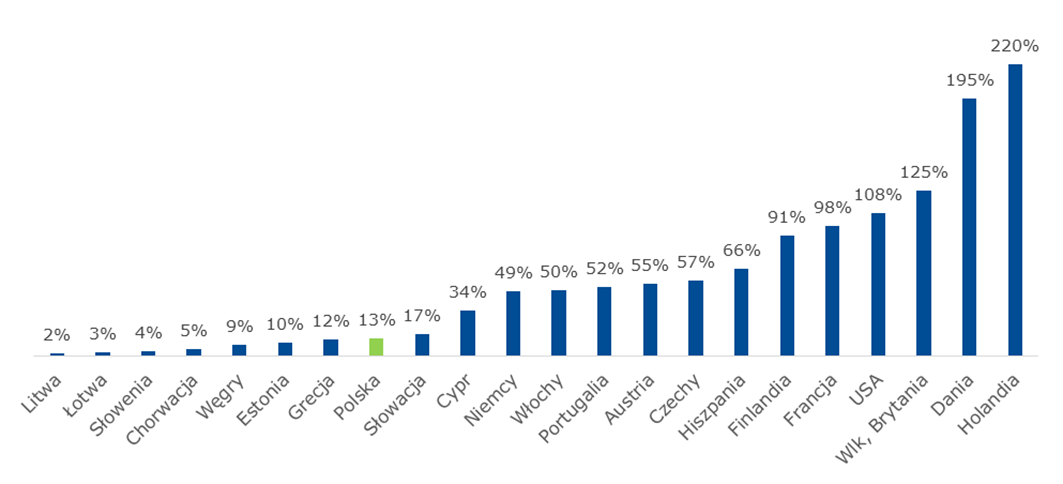

Outstanding non-Treasury bonds to GDP [%]

Source: Bank for International Settlements (non-Treasury bonds as at the end of Q2 2020 – most recent available data); IMF (estimated 2020 GDP, based on “Gross domestic product, current prices, USD”)

In 2020, GPW offered a range of initiatives in Poland to introduce companies and local governments to financing options available on all GPW markets. Due to the pandemic in Poland, the vast majority of those initiatives took place online. Those included conferences and special webinars dedicated to financing on the capital market. One-on-one meetings were held with potential issuers. The GPW Innovation Day was dedicated to companies which are planning to raise financing on GPW in the mid-term. In 2020, GPW launched the programme “Warto być spółką giełdową” addressed both to listed companies and companies which are considering going public. The programme offers several support packages including investor relations, regulations, marketing, and business aspects.

Treasury BondSpot Poland

Treasury BondSpot Poland (TBSP) operated by BondSpot S.A. is an electronic Treasury bond market and an integral part of the Treasury Securities Dealer system operated by the Ministry of Finance with the support of the National Bank of Poland and the banking industry. The main objective of the Treasury Securities Dealer system is to minimise the cost of public debt by improving liquidity, transparency and effectiveness of the Treasury securities market. TBSP includes :

- a market of cash transactions, and

- a market of conditional transactions (repo).

Activity of TBSP market participants was bolstered by measures initiated in previous years and continued in 2020, which ensure optimum solutions for a liquid, safe and transparent market, a broad offer of products addressing the needs of market participants, and competitive costs of market participation.

The value of trading on TBSP until mid-February 2020, in particular the value of outright transactions, was mainly driven by market factors impacting the interest rate market, concerns with rising inflation, and expected limited supply of bonds at auctions held by the Ministry of Finance owing to a strong position of the public budget. Those factors stabilised market volatility, resulting in less active trading by banks on TBSP. In the latter half of February and in the following months, the market was mainly impacted by the spread of SARS-CoV-2 (initially resulting in a sharp increase of volatility and market risk, causing investors to withdraw from bond funds) and Monetary Policy Council decisions aiming to offset the adverse impact of the pandemic by means of interest rate cuts and the emergency purchase of government bonds by the National Bank of Poland. Those factors impacted turnover both on the cash and on the derivatives market.

The Monetary Policy Council decisions and the National Bank of Poland operations resulted in a sharp reduction of market interest rates, including yields across the Treasury curve, which curbed transactional activity of market participants. However, the key driver which reduced their activity were regular redemptions of Treasury bonds (and instruments issued by PFR and BGK) by the National Bank of Poland. On the one hand, they are an effective tool supporting liquidity in the banking system (as banks do not need to source liquidity by selling Treasury bonds); on the other hand, they reduce the value of outstanding Treasury bonds in trading. Furthermore, the National Bank of Poland operations reduce the volatility of Treasury bond prices, which encourages banks to opt for the aforementioned competitive forms of negotiating and executing transactions.

Trading on the market is also affected by the bank tax, whose structure encourages banks to keep Treasury securities in their assets as they reduce the balance of assets which is the tax base. This implies a higher share of local banks among all holders of Treasury securities and a falling share of active non-residents. The tax structure also affects the activity of banks on the secondary market in sell/buy-back and repo transactions: on the one hand, it shortens the tenor of transactions and, on the other hand, directly limits trading activity on the repo market at the end of each month in order to contain the potential impact of opening transactions on the assets which form the taxable base.

As at 31 December 2020, TBSP had 29 market participants (banks, credit institutions, investment firms).

Participation in TBSP changed in 2020 as follows:

- J.P. Morgan AG joined as a Market Maker (in December),

- Raiffeisen Bank International AG stepped down as a Market Maker (in April),

- Getin Noble Bank changed its status from Market Taker to Institutional Investor (in May).

Treasury BondSpot Poland held 252 trading sessions from 1 January to 31 December 2020. The total number of transactions was 3,912. The total value of trade was PLN 169,125.01 million, a decrease of 40.1% year on year. The average value of trade per session was PLN 671.13 million. The share of cash transactions and conditional transactions (BuySellBack/SellBuyBack and Repo Classic) in total trade on TBSP was 21.4% (PLN 36,189.11 million) and 78.6% (PLN 132,935.90 million), respectively, in 2020.

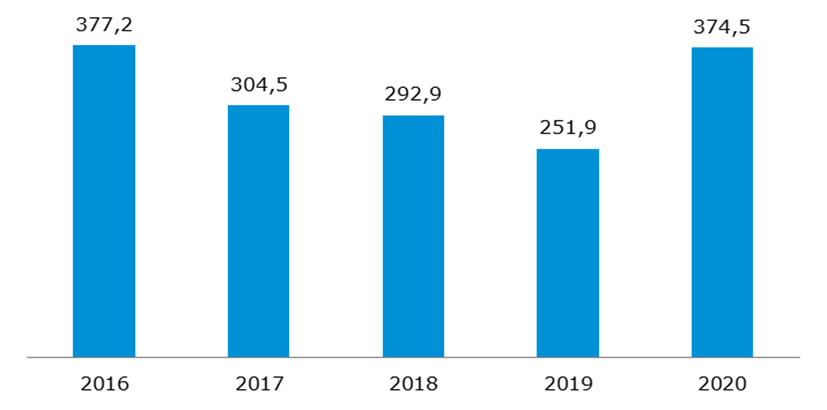

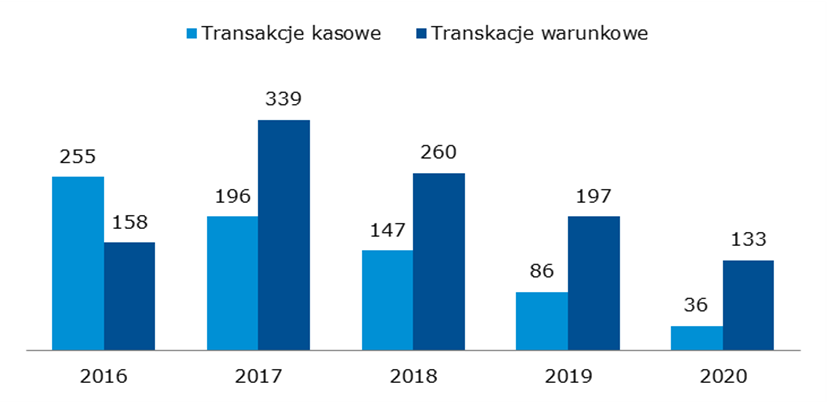

Value of trade on Treasury BondSpot Poland [PLN billion]

Listing includes admission and introduction to exchange trading and listing of securities on the markets organised and operated by the GPW Group. GPW listed 806 companies at the end of 2020 (433 companies on the Main Market and 373 on NewConnect), including 54 foreign issuers.

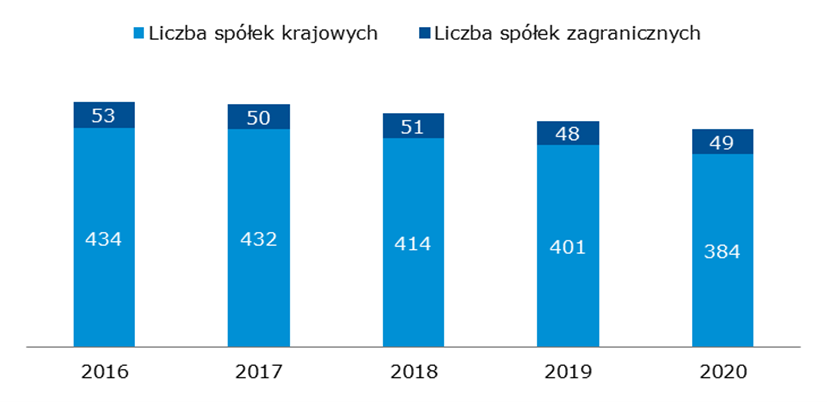

Number of domestic and foreign companies – Main Market

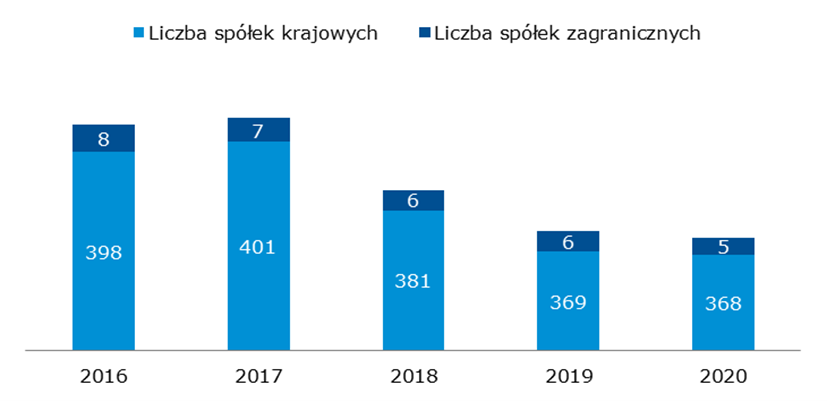

Number of domestic and foreign companies - NewConnect

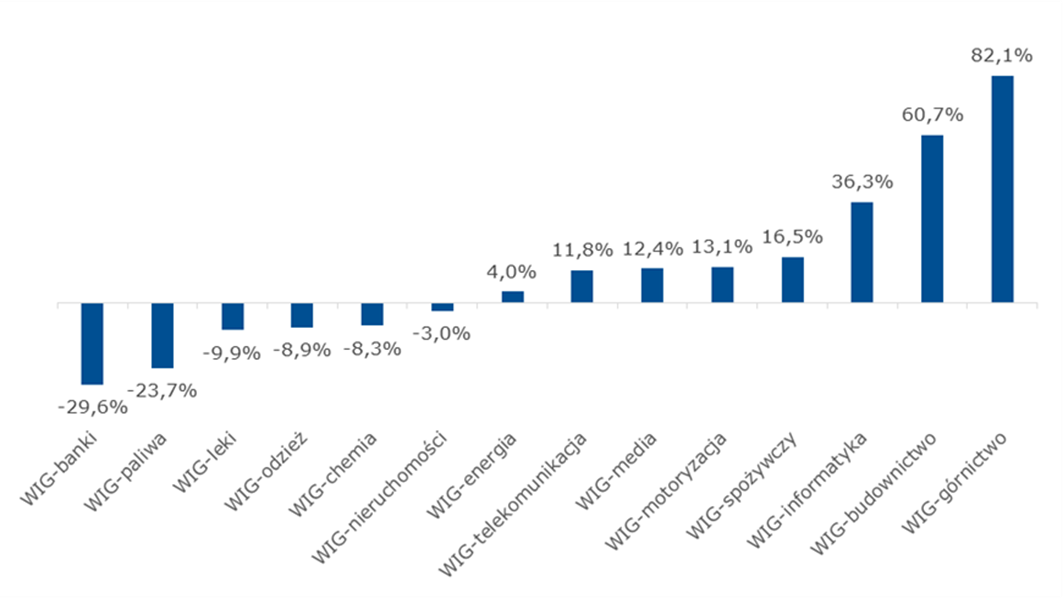

Change in sector indices in 2020 [%]

The change in sector indices was different in different sectors. The biggest return rate in 2020 was generated by WIG-Mining, WIG-Construction, and WIG-IT.

The total capitalisation of domestic and foreign companies on GPW’s two equity markets was PLN 1,089 billion at the end of 2020.

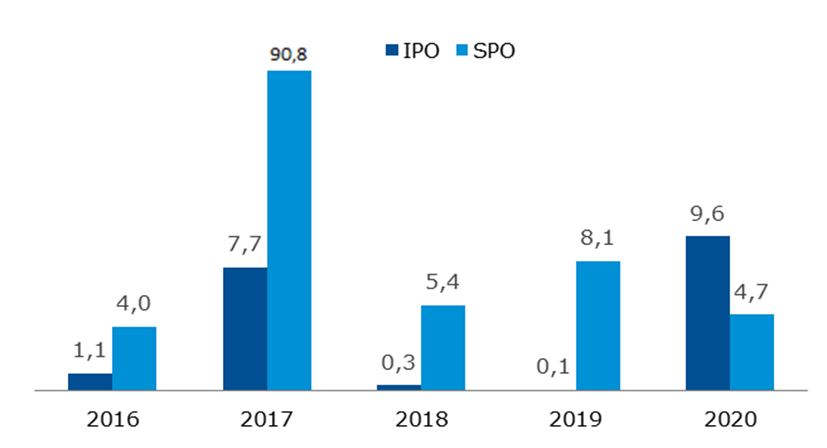

There were 21 new listings on GPW’s two stock markets in 2020 (including 2 companies which transferred from NewConnect to the Main Market) vs. 22 new listings in 2019. The total value of IPOs on the two stock markets was PLN 9.6 billion and the value of SPOs was PLN 4.7 billion in 2020.

Capitalisation of domestic and foreign companies – Main Market and NewConnect [PLN billion]

Value of IPOs and SPOs – Main Market and NewConnect [PLN billion]

The nominal value of non-Treasury debt listed on Catalyst was PLN 99.4 billion at the end of 2020 vs. PLN 92.1 billion at the end of 2019. Catalyst listed 455 series of non-Treasury debt instruments at the end of 2020 vs. 512 in 2019.

Issuers whose instruments were listed at the end of 2020 included 34 local governments (vs. 27 in 2019), 80 enterprises (vs. 99 in 2019), and 8 co-operative banks (vs. 14 in 2019). Including the State Treasury, the number of issuers on Catalyst was 128 at the end of 2020 vs. 145 at the end of 2019.

Information services on the financial market

GPW collects, processes and sells market data from all of the financial markets operated by the GPW Group. The status of GPW as the original source of information on trading and its strong brand and diversified business activity enable the Company to successfully reach various groups of market participants with advanced information adjusted to individual needs.

Revenue from information services of the parent entity consists of revenue earned on the sale of stock exchange information and data products including: real-time and delayed stock exchange data and statistical and historical data in the form of a online or e-mail daily statistical bulletin, electronic publications, calculation of indices, and other calculations. In addition to data from GPW, TGE, BondSpot and GPW Benchmark, the Company distributed reports of issuers listed on NewConnect and Catalyst to data vendors in 2020.

The sale of information is based on separate agreements signed with exchange data vendors, exchange members, and other organisations, mainly financial institutions. The Group’s revenue from information services also includes the revenue from BondSpot and GPW Benchmark information services.

The key groups of clients who use the GPW Group’s information services include:

- Data vendors

Specialised data vendors deliver data made available by the Company to investors and other market participants. Data vendors include information agencies, investment firms, internet portals, IT companies, and other entities with a diversified portfolio of services.

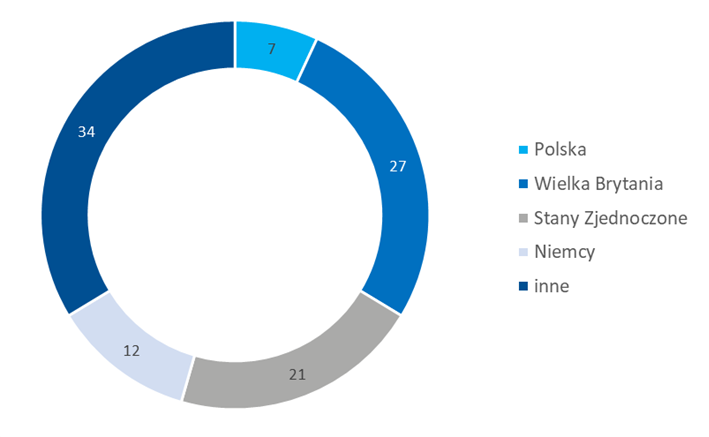

At the end of 2020, GPW had data vendors in Austria, Belgium, the Czech Republic, Denmark, Estonia, France, Germany, Ireland, the Netherlands, Norway, Switzerland, the United Kingdom, the USA.

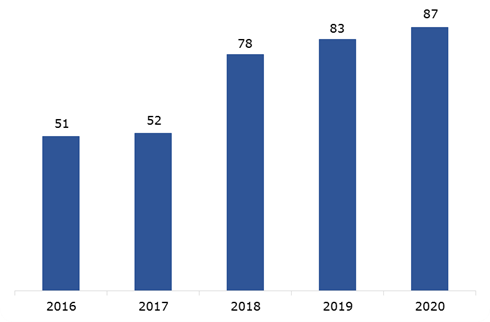

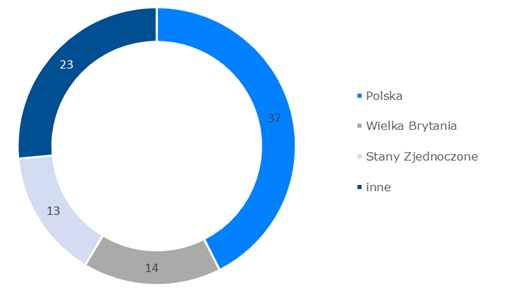

As at 31 December 2020, the GPW Group’s information services clients were 87 data vendors, including 37 domestic and 50 foreign ones, with subscribers using professional and basic data feeds.

GPW Group data vendors [#]

GPW Group data vendors by country [#]

- Individual and professional subscribers

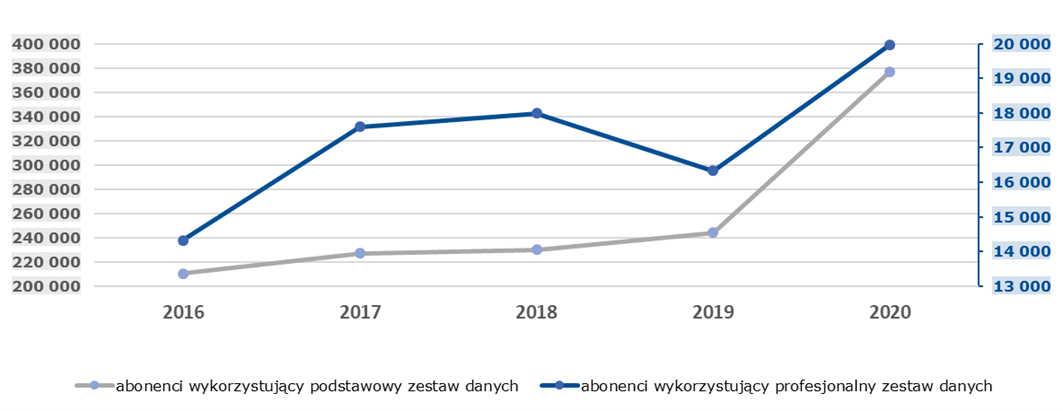

The GPW Group reported an increase of the number of real-time data subscribers across all investor categories.

GPW Group data subscribers [#]

- Non-display users of GPW Group data

Following intensive acquisition initiatives, GPW signed 22 new contracts for non-display data (used in algorithmic trading, risk management, portfolio valuation, systematic internalisers, and other non-display applications), including the first agreement concerning use of TGE data in risk management.

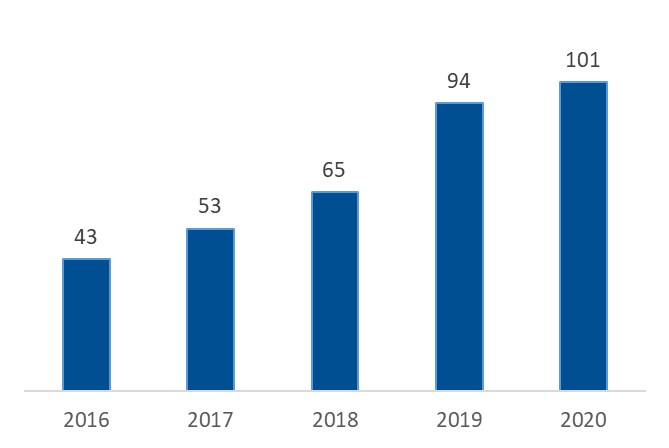

Non-display users of GPW Group data [#]

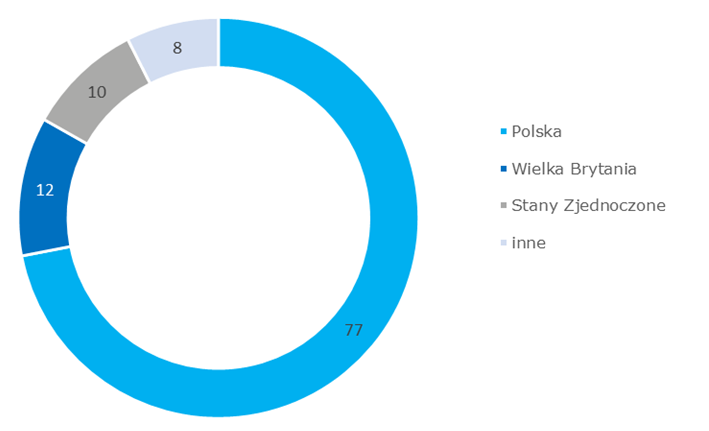

Non-display users of GPW Group data by country [#]

- Processed data and benchmarks

In addition to real-time and delayed data, GPW offers a broad range of advanced value-added information products used by financial institutions in analytics. Diverse data and indicators are available in packages addressed to specific segments of the financial market in user-friendly formats.

The main users of processed data and benchmarks in 2020 included investment funds, banks, news agencies, pension funds, brokers and insurers.

Users of processed data and benchmarks [#]

Users of processed data and benchmarks by country [#]

Numbers of data vendors, their subscribers and non-display users, as at 31 December

| 2020 | 2019 | 2018 | 2017 | 2016 | |

|---|---|---|---|---|---|

| Number of real-time data vendors | 87 | 83 | 78 | 52 | 51 |

|

domestic |

37 | 37 | 36 | 27 | 27 |

|

foreign |

50 | 46 | 42 | 25 | 24 |

| Number of real-time data subscribers [thou.] | 397,0 | 206,3 | 247,9 | 244,4 | 224,4 |

|

number of subscribers using professional data feeds |

20,0 | 16,3 | 17,9 | 176,6 | 14,3 |

| Number of non-display users of GPW data | 101 | 94 | 65 | 53 | 43 |

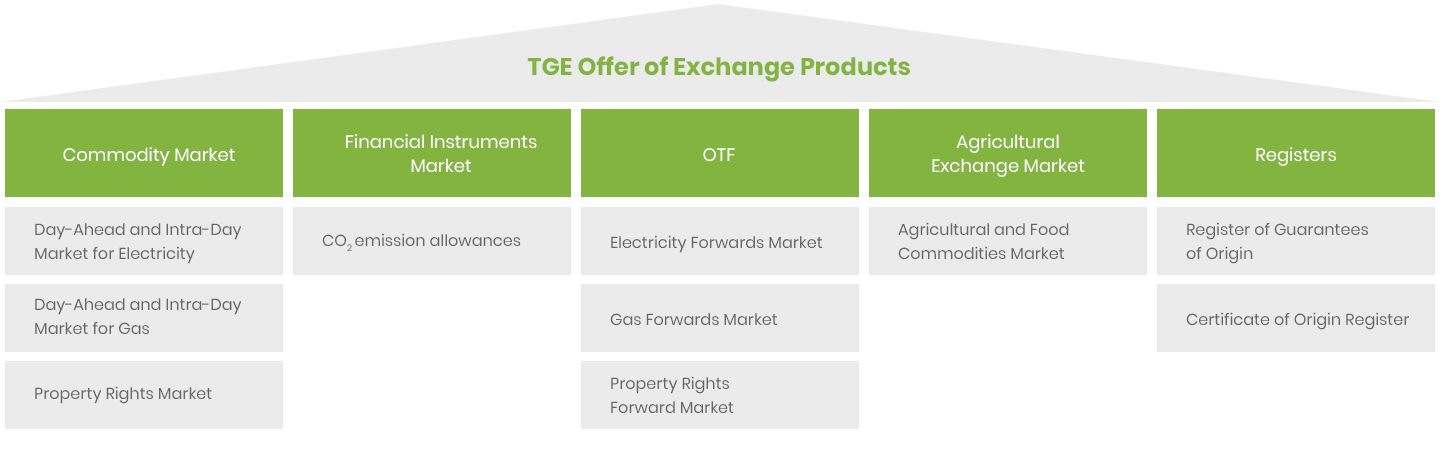

Commodity market

The activity of the GPW Group on the commodity market is concentrated in the Towarowa Giełda Energii Group which is comprised of TGE, its subsidiary Izba Rozliczeniowa Giełd Towarowych, as well as the OTC platform InfoEngine. The activity of the Towarowa Giełda Energii Group includes:

- operation of markets which offer trade in:

- electricity;

- natural gas;

- greenhouse gas emission allowances;

- property rights in certificates of origin of electricity, biogas and energy efficiency;

- food and agricultural products (wheat, rye, maize);

- operation of the Register of Certificates of Origin and the Register of Guarantees of Origin;

- operation of the trade reporting system TGE RRM;

- clearing of transactions on the commodity exchange.

Trading

Trading on TGE commodity markets TGE

Electricity market

- Day-Ahead and Intra-Day Market

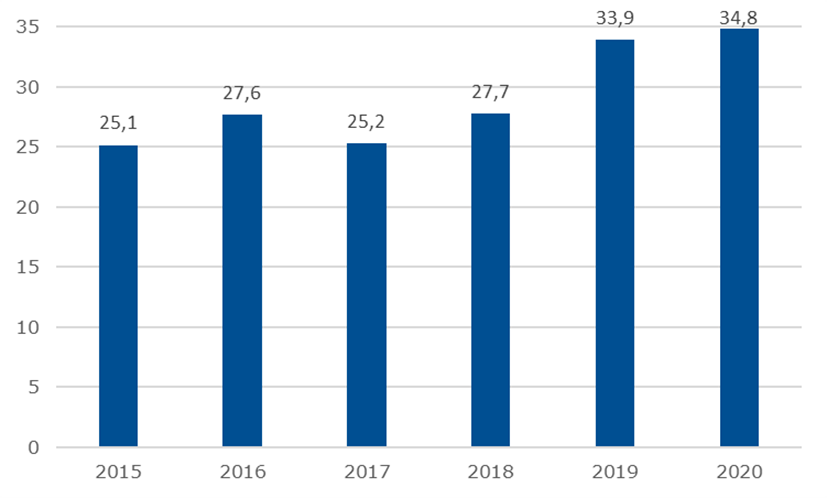

The volume of trade increased by 2.8% year on year in 2020, setting a historical record of 34.8 TWh. A modest decrease in turnover on the Day-Ahead Market was accompanied by a strong growth on the Intra-Day Market.

Volume of trade in electricity on the Day-Ahead and Intra-Day Market [TWh]

- forward electricity market on the OTF since May 2020

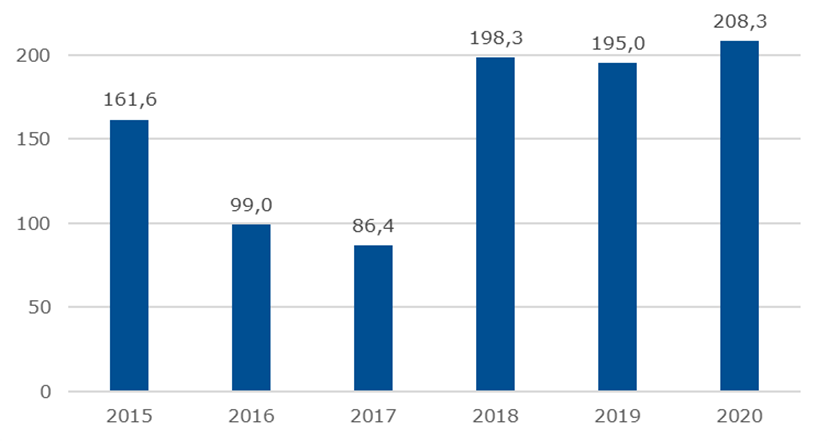

The volume of trade in 2020 increased not only year on year (by 6.8%) but also compared to the record year 2018 (by 5.0%). The volume of trade reached 208.3 TWh in 2020. A majority of turnover (112.4 TWh) was generated in H1 for the first time since 2016. No longer a part of the Commodity Forwards Market since May, the market operates under the abbreviated name RTPE on the Organised Trading Facility

Volume of trade on the forward electricity market [TWh]

Gas market

- Day-Ahead and Intra-Day Market

- forward gas market on the OTF since May 2020

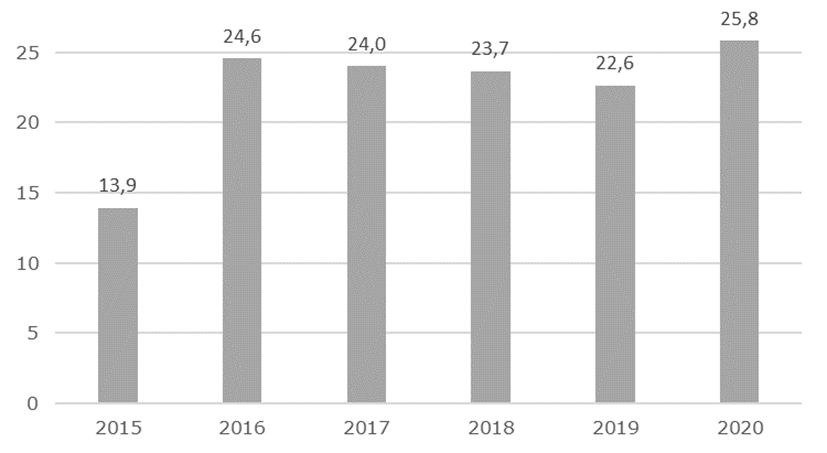

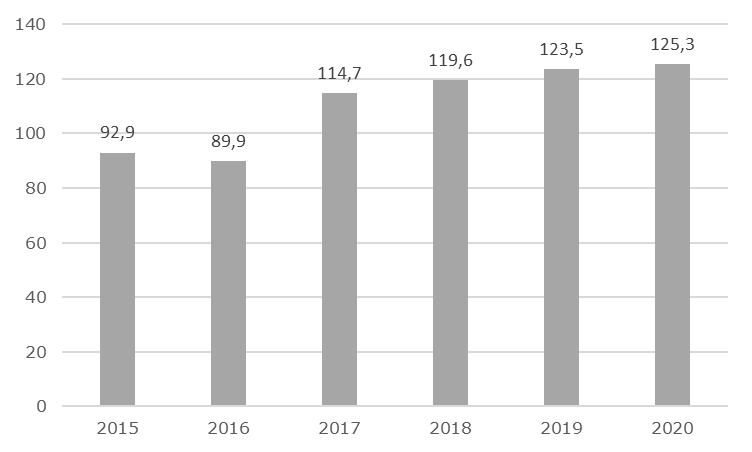

The total volume of trade on the gas markets was 151.1 TWh in 2020, representing an increase of 3.4% year on year and a historical record. The annual turnover was record-high both on the spot market and on the forward market. The volume of trade on the Day-Ahead and Intra-Day Market was 25.8 TWh, an increase of 14.0% year on year and 5.0% more than in the record year 2016. The volume of trade on the Day-Ahead Market was 19.9 TWh (historically high and an increase of 17.6% year on year) and the volume of trade on the Intra-Day Market was 5.9 TWh (an increase of 3.3% year on year). The volume of trade on the forward market, which operates since May under the abbreviated name RTPG on the Organised Trading Facility, was record-high at 125.3 TWh, up by 1.5%. In contrast to the electricity market, the gas market did not experience a temporary sharp fall in consumption due to economic restrictions in Poland during the pandemic.

Volume of trade in natural gas on the Day-Ahead and Intra-Day Market [TWh]

Volume of trade on the forward gas market [TWh]

Property Rights Market

TGE operates a Property Rights Market in certificates of origin of electricity produced:

- from renewable energy sources without naming the production technology, excluding biogas (PMOZE and PMOZE_A, known as green certificates),

- from agricultural biogas (PMOZE-BIO, known as blue certificates).

- Furthermore, the Property Rights Market lists:

- property rights in certificates of origin of biogas (PMBG, known as brown certificates),

- property rights in energy efficiency certificates (PMEF, annual PMEF and PMEF_F, known as white certificates).

The Property Rights Market is a part of the support scheme for producers of energy from renewable energy sources. It allows producers of energy from renewable energy sources and biogas and holders of energy efficiency certificates to sell property rights, and energy operators required to pay substitution fees or to cancel certificates of origin to meet that obligation.

The volume of trade on the Property Rights Market is driven by the number of certificates issued in the Register of Certificates of Origin: increased production of energy generates the obligation to issue more certificates of origin, which in turn generates an increase of the volume of certificates of origin available on the market.

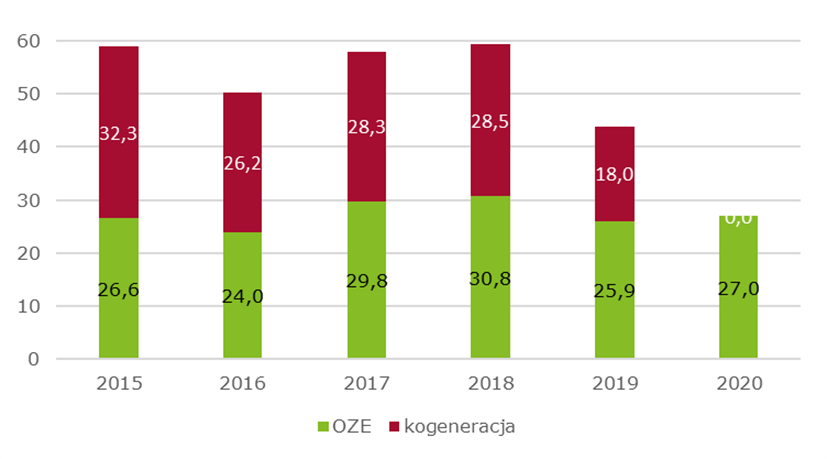

Trading in RES instruments (PMOZE, PMOZE_A and PMOZE-BIO) on the electronic order book reached 10.2 TWh in 2020 and non-EOB trade was 16.8 TWh. The total volume was close to 27.0 TWh in 2020, an increase of 4.0% year on year. The volume of issued RES property rights increased to 22.3 TWh and was the highest since 2017.

Trade in white certificates (PMEF, PMEF-2019, PMEF-2020, PMEF_F) decreased sharply in 2020. The total volume was 191.0 ktoe, a decrease of 61.2% year on year. EOB trade stood at 143.0 ktoe (down by 67.2%) and non-EOB trade was 48.0 ktoe (down by 15.1%). The main reason for the low turnover was the reduced supply of certificates due to a low volume of issued property rights (down by 46% year on year and 40% against 2018) as well as a high base of the record-setting year 2019.

Volume of trade in property rights to certificates of origin [TWh]

The Register of Certificates of Origin is a system of registration and recording of:

- certificates of origin which confirm that electricity was generated from renewable energy sources (RES);

- certificates of origin which confirm that agricultural biogas was produced and introduced to the gas distribution network;

- energy efficiency certificates which confirm that the project improved energy efficiency;

- property rights under such certificates.

- The main functions of the Register of Certificates of Origin include:

- to identify entities entitled to property rights in certificates of origin;

- to identify property rights under certificates of origin and the corresponding quantity of electricity;

- to register certificates of origin and the resulting property rights;

- to record transactions in property rights and balances of property rights in certificates of origin;

- to issue documents confirming property right balances in the register, used by the Energy Regulatory Office for cancellation of certificates of origin.

Certificates issued and cancelled (Register of Certificates of Origin)

RES – Green Certificates

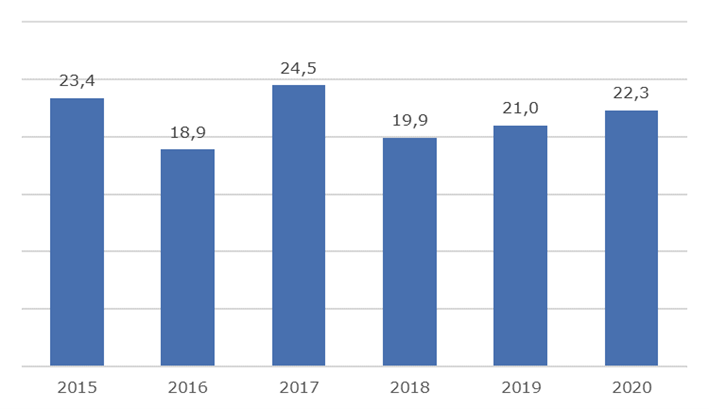

The volume of issued green certificates was 22.3 TWh in 2020, an increase of 6.5% year on year (21.0 TWh in 2019).

Volume of issued RES property rights [TWh]

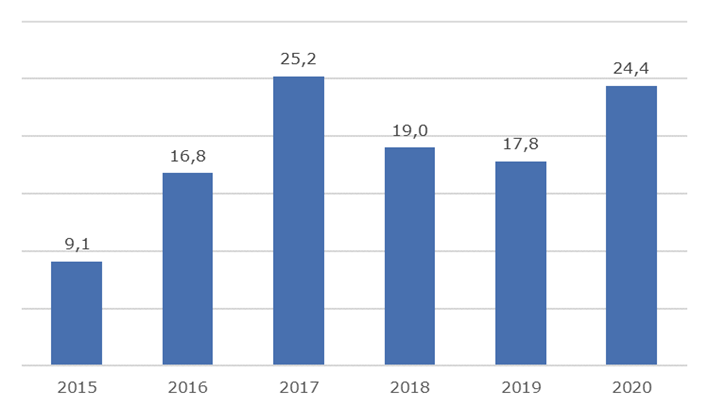

The volume of cancelled green certificates was 24.4 TWh in 2020 vs. 17.8 TWh in 2019. The volumes of cancelled certificates increased sharply among other due to an increased obligation to cancel RES certificates of origin (20% in 2020, 19% in 2019).

Volume of cancelled RES property rights [TWh]

Energy efficiency: white certificates

120.1 thousand toe of white certificates were issued in 2020, a decrease of 46.4% year on year compared to 224.1 thousand toe in 2019. The volume of cancelled white certificates was 327.2 thousand toe in 2020 vs. 459.7 thousand toe in 2019.

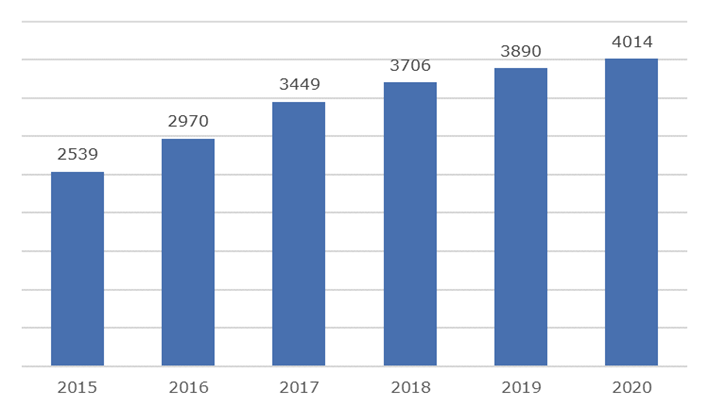

Number of participants of the Register of Certificates of Origin

The Register of Certificates of Origin had 4,014 participants at the end of 2020. In 2020, 124 companies became members of the Register of Certificates of Origin (274 companies in 2019).

Number of participants of the TGE Register of Certificates of Origin

NUMBER OF TGE MEMBERS

In 2020, there were 79 members on the Commodity Market, 49 members on the Organized Trading Platform (OTF), and 7 members on the Financial Instruments Market.

Following the launch of the Organised Trading Facility (OFE) in May 2020, TGE modified the broker training and examination format. Training now covers the key issues necessary for participants to prepare for trading on all TGE markets. Training participants who pass the examination receive the TGE Broker certificate which authorises Exchange Members or OTF Members to be entered into the TGE Broker Register and to broker trade on the Commodity Market, the Organised Trading Facility and the Financial Instruments Market subject to the requirements of the market rules.

In 2020, TGE delivered three training rounds (in Polish and/or English) closed with examinations for 38 participants. A refresher course was offered to holders of broker certificates under the previous terms on the Commodity Market or the Financial Instruments Market. Due to restrictions imposed during the pandemic, TGE offered training by means of remote communication. As a result of the training programmes, 373 TGE Broker certificates were issued in 2020.

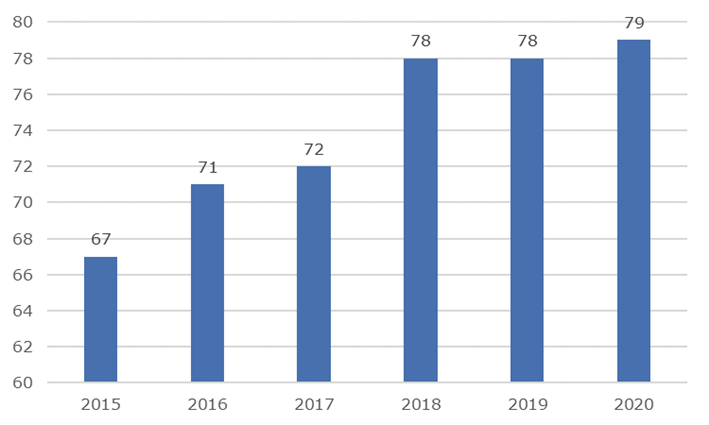

Number of TGE members in 2015-2020

TGE operates a Register of Guarantees of Origin and organises trade in guarantees of origin. The Register of Guarantees of Origin launched in September 2014 and registers energy from renewable sources and OTC trade in environmental benefits of its production. Unlike certificates of origin, guarantees do not involve property rights or a support scheme for renewable energy sources: they are issued for information only. There is no obligation to acquire guarantees but they can be used by entities to prove that a certain quantity of consumed energy was generated from renewable sources. TGE offers trade in guarantees of origin of energy since November 2014.

According to the regulations, the Energy Regulatory Office issues guarantees of origin which are then uploaded to the IT system of the Register of Guarantees of Origin operated by TGE. System users can trade in guarantees of origin or transfer them to end users as proof that energy was generated from renewable sources.

In October 2019, the Register of Guarantees of Origin was extended to include a module of guarantees of origin of high-efficiency cogeneration. 3.4 TWh of cogeneration guarantees were uploaded into the system. The number of applications for participation in the Register of Guarantees of Origin increased sharply in Q4 2019 following the addition of photovoltaic installations developed by auction winners.

A module of Guarantees of Origin from high-efficiency cogeneration was added to the Register of Guarantees of Origin in October 2019.

The Register of Guarantees of Origin had 824 participants at the end of 2020. 205 members joined in 2020 (180 members joined in 2019).

| Inssued | Sold | Transferred | |

|---|---|---|---|

| TWh | GWh | GWh | |

| 2015 | 7,23 | 635 | 732 |

| 2016 | 12,3 | 591 | 702 |

| 2017 | 12,6 | 2548 | 2875 |

| 2018 | 17,0 | 16848 | 13645 |

| 2019 | 21,5 | 1 9138 | 14 693 |

| 2020 | 21,2 | 1 8323 | 13,776 |

TRADE REPORTING – TGE RRM

TGE offers a Registered Reporting Mechanism (RRM) to electricity and gas market participants under the requirements of REMIT and its Implementing Regulations, including reporting of trades on organised trading platforms as of 7 October 2015 and OTC trade reporting as of 7 April 2016. All information required under REMIT and Regulation 1348/2014 is reported for the electricity market and the gas market.

Until the end of 2020, there were:

- 43,014,226 reported operations on exchange orders,

- 19,424,858 reported exchange orders,

- 7,645,507 reported exchange transactions,

- 275,125 reported OTC transactions,

- 300,120 exchange reports sent to ARIS,

- 62,568 OTC reports sent to ARIS,

- reporting services for 620 clients - ACER has registered 689 entities, which means that TGE reports for nearly 90% of participants of the Polish energy market,

- over 1,950 users have access to TGE RRM.

On 22 October 2020, TGE started to sell processed data on the dedicated platform AIR (Analysis, Information, Reports). There were 28 information products in 2020, including daily and periodic reports as well as aggregate data packs summarising trading sessions on TGE’s markets, available in three or twelve month subscription.

TGE real-time data were sold through the Warsaw Stock Exchange to:

- 3 exchange members providing market data to their clients (Noble Securities SA, Dom Maklerski BOŚ, innogy Polska SA);

- 3 professional data vendors (Refinitiv, Bloomberg, Montel).

Izba Rozliczeniowa Giełd Towarowych S.A. (IRGiT) clears all markets operated by Towarowa Giełda Energii S.A. (TGE). IRGiT is authorised as a clearing house and a settlement institution under the Act on Trading in Financial Instruments and operates as an authorised exchange clearing house under the Commodity Exchange Act. IRGiT celebrated the 10th anniversary of its operating business in 2020.

In 2020, IRGiT provided clearing services as an exchange clearing house (GIR) for commodities traded on the Commodity Market (RTG), the Organised Trading Facility (OTF), and the Food and Agricultural Commodity Market, and as a clearing house and a settlement institution (IRR) for financial instruments traded on the Property Rights Forward and for CO2 Emission Allowances traded on the Financial Instruments Market (RIF).

The total volume of cleared transactions in electricity was 705 TWh, the total volume of cleared transactions in gas was 500 TWh, and the total volume of cleared transactions in property rights was 54 TWh in 2020. IRGiT served over 60 direct members and more than 200 entities operating via brokers in 2020 under a settlement model operated in partnership with 10 banks.

Clearing guarantee system

The clearing guarantee system organised and administered by IRGiT aims to protect the safety of clearing and settlement for all participants of cleared markets, in particular by managing counterparty credit risk and accepting collateral of the appropriate value and quality. The system ensures high stability and certainty of the execution of trades on agreed terms for all market participants, including in the event of counterparty default, even under extreme market conditions.

The system operated by IRGiT relies on international standards and risk management rules. In its risk management, IRGiT takes into account a broad range of risks, including financial risks (i.e., credit risk, liquidity risk, market risk) and a range of non-financial risks.

The clearing guarantee system includes deposits, margins, and guarantee funds in which members post collateral. They cover the risks mentioned above.

Deposits cover cash flows in respect of physical delivery under cleared trades. Margins include initial margins and additional margins. Initial margins cover potential future exposure to price risk under normal market conditions in the event of clearing member default. IRGiT’s initial margining methodology is based on a historical Value-at-Risk model. Additional margins represent aggregate mark-to-market and mitigate the risk of current price volatility.

As a part of the guarantee system, IRGiT administers the Non-cash Collateral Register which records collateral posted against margin requirements and guarantee funds. The model accepts collateral including bank guarantees, CO2 emission allowances (EUA), property rights in RES certificates of origin (PMOZE_A). Accepted collateral is subject to haircuts reflecting the risk of change of valuation within the liquidation horizon. Each element of the system includes concentration limits on posted collateral which mitigate liquidity risk.

In 2020, IRGiT continued to optimise costs paid by market participants trading on the exchange on the one hand while improving safety measures on the other hand. In 2020, IRGiT modified the non-cash collateral model in order to make it more flexible and to provide cost optimisation to IRGiT clients. In particular, bank guarantees are now accepted in the guarantee fund. The new model accepts bank guarantees up to 60% of guarantee fund contributions. The model also accepts bank guarantees issued by banks established outside of Poland. A new bank guarantee template was designed. As of 1 September 2020, IRGiT implemented a cross-product netting model for initial margins on the Electricity Forwards Market. The modifications to IRGiT’s guarantee system enable market participants to reduce initial margins by up to 100% compared to the previous model. The implementation of cross-product netting closes the first of two phases of the implementation of a comprehensive netting model recommended by the IRGiT Risk Committee. The objective of the modifications is to improve the effectiveness of IRGiT’s guarantee model while protecting the high level of safety in clearing.

In connection with the introduction of the Act amending certain Acts with regard to protection measures in connection with the spread of SARS-CoV-2, IRGiT modified its collateral system in 2020 in line with the requirements of the Act. The modifications concerning collateral acceptable under the Act were in force up to 30 September 2020.

IRGiT’s clearing guarantee system passed the test in March 2020 when European energy markets faced very high volatility due to the economic impact of the COVID-19 pandemic. Sharp adverse price volatility and its impact on additional margins exerted liquidity pressures on IRGiT members holding long net positions in forward contracts. IRGiT was notified by one member that it would default under its trades and immediately decided to announce its default under the GIR Rules (commodity market) and to close out all open positions. As a result of extreme price movements on the forward market, the member’s collateral posted before the default was insufficient to cover the loss. With a view to the foregoing, in accordance with the GIR Rules (commodity market), IRGiT was authorised to use collateral posted by other members in the guarantee fund. Acting in the interest of its members, IRGiT took measures necessary to replenish the resources of the guarantee fund. All resources were reimbursed to IRGiT members on 10 December 2020.

Risk Committee

IRGiT’s risk management system includes a Risk Committee which issues opinions and provides advice to IRGiT in matters concerning regulations or arrangements which impact the risks of IRGiT’s clearing services and as such directly impact the safety and effectiveness of the clearing guarantee system. The Risk Committee is comprised of representatives of IRGiT clients’ organisations, a representative of Towarowa Giełda Energii S.A. and a representative of IRGiT.

The Risk Committee held four meetings in 2020 including one extraordinary meeting. The Committee provided a number of recommendations setting the direction of development of the clearing guarantee system. Summary reports of Risk Committee meetings are published on the IRGiT website.

Development activities of IRGiT

In 2020, IRGiT continued to pursue its development plans aligned with the TGE Group strategy and the project map for 2018-2020, including initiatives implemented under the Warsaw Stock Exchange strategy.

In 2020, IRGiT started to clear new markets operated by Towarowa Giełda Energii: the Organised Trading Platform (OTF), the Food and Agricultural Commodity Market, and a new instrument introduced to the Financial Instruments Market: CO2 Emission Allowances.

IRGiT carried out several other projects in 2020 including the development of a clearing model in the SPOT Market Project (XBID, MNA, CORE - Interim Coupling, JAO), development of a new version of the PCCP3 clearing system, development and implementation of tools supporting the service of reporting IRGiT member’s trades on the Property Rights Forward Market, and the aforementioned development of the risk management system.

IRGiT put in place a range of solutions to address the COVID-19 pandemic in 2020 including alignment of the company’s systems with solutions implemented in favour of market participants under the Anti-Crisis Shield programme as well as technological solutions ensuring business continuity and operational security in the remote work regime.